Why Income Protection Might Be a Better Choice Than Workers Compensation

When it comes to securing your financial well-being, it's crucial to understand the differences between Income Protection insurance and Workers Compensation. While both are designed to provide financial support in the event of an injury or illness, Income Protection often offers more comprehensive coverage. Here's a deeper dive into why Income Protection might be the better option for you:

Comprehensive Coverage

Income Protection insurance is designed with flexibility in mind. It pays out benefits regardless of where the sickness or injury occurs—whether at work, at home, or anywhere else. This means that if you fall ill or get injured while on vacation, during a weekend hike, or even while doing household chores, you can still receive financial support. The specifics of the coverage will depend on your policy details and the type of cover you choose, but the overarching benefit is clear: you're protected in a wide range of scenarios.

State-Specific Limitations of Workers Compensation

Workers Compensation is a state-regulated benefit, meaning the rules and coverage can vary significantly depending on where you live. For example, in New South Wales (NSW), Workers Compensation is only payable if there is a real and substantial connection between your employment and the accident or incident that caused the injury. This can sometimes make it difficult to qualify for benefits, especially if the injury occurs outside of work hours or in situations not directly related to your job.

Financial Risks of Relying Solely on Workers Compensation

The narrow terms applied to Workers Compensation policies can leave many Australians vulnerable. Since the majority of accidents and injuries occur at home or during leisure activities, relying solely on Workers Compensation for financial protection can be risky. If an injury happens while you're gardening, playing sports, or simply enjoying a day off, Workers Compensation may not cover you. This gap in coverage can lead to significant financial hardship, especially if you're unable to work for an extended period.

The Broader Safety Net of Income Protection

Income Protection insurance provides a broader safety net, ensuring that you're covered in more situations. This type of insurance is designed to replace a portion of your income if you're unable to work due to illness or injury, regardless of where or how it happens. This can be particularly reassuring for those who engage in activities outside of work that carry a risk of injury. By having Income Protection, you can focus on your recovery without the added stress of financial instability.

While Workers Compensation has its place and can be beneficial for work-related injuries, it has limitations that can leave you exposed. Income Protection, with its broader coverage and flexibility, offers a more comprehensive solution. It ensures that you're protected in a variety of scenarios, helping to prevent financial disaster and providing peace of mind. When considering your options, it's essential to evaluate your lifestyle and the potential risks you face, ensuring you choose the coverage that best meets your needs.

Get a QuoteNomination of Beneficiaries for Your Life Insurance: A Comprehensive Guide

Nominating beneficiaries for your life insurance policy is a crucial step in ensuring that your loved ones are financially protected if you pass away. By making a nomination, you designate individuals who will receive the proceeds of your life cover. These individuals are known as your beneficiaries. You can specify what proportion of the benefit each beneficiary will receive, and you can update your nominations at any time to reflect changes in your circumstances.

Who Can Be Nominated for Your Life Insurance?

The rules for nominating beneficiaries depend on whether your life insurance policy is held inside or outside of superannuation. Policies held within a superannuation structure have stricter rules, and nominations must comply with superannuation laws.

For policies inside superannuation, you can nominate:

Dependents:

This includes your spouse, de facto spouse, legally married spouse, same-sex partner, and children (including adopted children) as defined under the Family Law Act 1975. It also includes any person who is financially dependent on you or someone with whom you have an interdependency relationship.

Interdependency Relationship:

This refers to individuals with whom you share a close personal relationship, live together, and provide mutual domestic, financial, and personal support.

Legal Personal Representative (Your Estate):

This is the executor of your estate, who will distribute your life insurance benefits according to your will or state-based intestacy laws if no valid will exists.

Making a Valid Nomination for Your Life Insurance

To ensure your loved ones can access your life insurance benefits quickly and with peace of mind, it is essential to make a valid nomination. This typically involves having two witnesses sign your nomination form. The nomination must be completed in writing, either as part of the initial insurance application or by submitting a separate nomination form to your insurer at a later date.

If no valid nomination is in place, the proceeds of your life insurance policy may be paid to your estate (if the policy is held outside of superannuation) or to the trustee of the policy (if held within superannuation). The trustee will then decide how to distribute the proceeds, which can be a lengthy process and may cause stress for potential beneficiaries if disputes arise.

Considerations for Tax Consequences

It's important to be aware that there may be tax implications depending on who you nominate as your beneficiary. These tax consequences should be considered carefully before making your nomination.

To ensure your nominations are valid and up-to-date, consider consulting with Morgans Insurance Advisors as your preferred life insurance broker. We can help you navigate the complexities of life insurance nominations and ensure your loved ones are protected.

Get a QuoteUnderstanding Stepped Premiums: A Detailed Guide

When it comes to life insurance, understanding how life insurance premiums are influenced and calculated is crucial. One such type is stepped premiums, which increase each year in line with your age. This approach helps insurance companies manage their risk. Generally, the older you get, the higher your stepped premium will be. At this point, you might choose to continue paying the increased premium, reduce your insurance coverage, or even cancel your policy altogether.

Stepped vs. Level Premiums

Stepped premiums are initially less expensive than level premiums. However, depending on when your insurance was implemented (considering your age and occupation at the time), a stepped premium may eventually become more expensive than a level premium. This shift depends on factors like your age, occupation, and the duration of your policy.

Factors Influencing Stepped Premium Increases

Several factors can cause your stepped premiums to rise:

Indexation

Indexation on your insurance (including Life, Total and Permanent Disability, Trauma, and Income Protection Insurance) will increase your premiums. As the amount of your insurance coverage increases, so will the corresponding premium, calculated based on the increase due to indexation and your age.

Government Stamp Duty

Changes to legislated government stamp duty in each State and Territory can affect the cost of your insurance premiums. Depending on your coverage, you may be legally required to pay stamp duty, which is reflected in your life insurance premiums.

Premium Rate Reviews

Life insurance companies periodically review premium rates. If the cost of coverage increases beyond the insurance companies’ expectations, a rate increase may apply to all customers. These revised premiums could result from an increase in claims or changes in the economic environment. In such cases, the insurance company will notify clients of these changes.

Expiry of Discounts

In certain circumstances, stepped premiums may increase due to the expiration of initial or term discounts on policies like Life, Total and Permanent Disability, Trauma, and Income Protection Insurance.

Policy Changes

Any changes you request to your policy in line with your evolving needs can also affect stepped premiums. These changes might decrease your premiums. For instance, you can remove optional benefits or have loadings reviewed if they have been applied to your policies.

Managing Increasing Premiums

If your policy increases have become burdensome, it’s wise to have your life insurance policy reviewed by Morgan Insurance Advisors—obligation-free. Before reviewing your policy, they will consider any changes to your circumstances, such as your medical history or occupation.

Feel free to reach out if you need more information or further assistance!

Get a QuoteUnderstanding Income Protection Insurance: A Comprehensive Guide

Ensuring financial security is a top priority for you and your loved ones. One of the most crucial steps in achieving this is implementing income protection. This decision can provide financial stability and security when you are unable to work due to illness or injury, whether temporarily or long-term.

How Does Income Protection Work?

Income protection insurance provides you with a regular monthly income for a predetermined period or until you can return to work, either full-time or part-time. Benefit periods typically offer options of 2 years, 5 years, or up to age 65.

Generally, the maximum cover you can apply for is up to 70% of your gross income from employment and superannuation contributions. However, there may be offset clauses if you receive other sources of income, depending on the insurance provider and the conditions outlined in the product disclosure statement.

If your policy includes superannuation contributions, this portion of your income protection will be paid towards your superannuation while you are unable to work fully.

Understanding Waiting Periods

Another critical factor to consider is the waiting period, which can vary from 14 days, 30 days, 90 days, or 180 days from the date of disablement or illness.

It's important to note that if you take out income protection through your superannuation, the cost of the insurance comes out of your retirement savings. This approach minimises the impact on your current household expenses but does affect your overall retirement savings.

Additional Considerations

Depending on your insurance provider and whether you are classified as a 'White Collar' or 'Heavy Blue Collar' worker, there may be additional qualification requirements to make a successful claim.

To ensure you have the right policy tailored to your individual needs, be sure to contact Morgan Insurance Advisors.

Get a QuoteHow Does Life Insurance Work?

Life cover revolves around a fundamental concept, yet not all life insurance policies are created equal. Here’s what you should know about the mechanics of life insurance, the coverage it provides, and the process for receiving benefits if the unexpected occurs.

What is Life Insurance?

Life insurance, also referred to as term life insurance or death cover, offers a lump sum payment to your chosen beneficiaries upon your death. This payout can help your loved ones cover various expenses, including mortgage payments, debts, childcare and school fees, and everyday living costs.

Some policies also provide terminal illness cover, which pays a lump sum if you are diagnosed with a terminal illness and have a limited life expectancy. Life cover can be purchased on its own or combined with other insurance types, such as total and permanent disability (TPD), trauma insurance, or income protection insurance.

What Does Life Insurance Cover?

Here’s a breakdown of what is typically covered by life insurance policies –

Death Benefits –

Life insurance provides a lump sum payment to your designated beneficiaries upon your death. This payout helps your loved ones manage various expenses, including –

- Mortgage Payments – Covering outstanding balances to keep your home.

- Debts – Paying off credit cards, personal loans, or car loans to avoid burdening your loved ones.

- Childcare and School Fees – Assisting with costs related to childcare and education.

- Everyday Living Expenses – Supporting ongoing costs like groceries and utilities.

Terminal Illness Benefits –

Many policies include terminal illness cover, offering a lump sum if you are diagnosed with a terminal illness and have a limited life expectancy. This payout can help with –

- Medical Expenses – Covering treatment, medication, and palliative care costs.

- Financial Support – Maintaining your family’s standard of living while you’re unable to work.

Accidental Death Benefits –

Some policies offer higher payouts in the event of accidental death, providing extra financial support for unexpected costs.

Additional Considerations –

- Exclusions – Life insurance policies often have exclusions, such as suicide within a specific timeframe after the policy starts. It’s essential to review the Product Disclosure Statement (PDS) for details.

- Policy Structure – Life cover can be standalone or linked with other insurance types, which may offer lower premiums but could reduce overall benefit payouts.

How Will Your Policy Be Structured?

Many superannuation funds in Australia automatically provide a basic level of life insurance to their members, and you may have the option to increase your coverage through your super fund. However, it’s important to note that with superannuation-linked policies, the trustee of the super fund is technically the policyholder. In the event of your death, the trustee receives the benefit from the insurer and then distributes it to your beneficiaries according to your instructions or your estate.

When considering life insurance, you should also evaluate your policy terms. Term life insurance is a popular choice that offers coverage for a specified period, often with options to renew until a certain age. If you outlive the policy term, the coverage expires unless you choose to renew it, which may come at a higher premium. Conversely, whole life insurance, although less common in Australia, provides permanent coverage for your entire life, ensuring continuous protection without the need for renewal.

As you apply for life insurance, the insurer will assess your individual risk through a process called underwriting, which considers factors such as your age, health, medical history, and lifestyle. This assessment will determine whether coverage is offered and what your premium payments will be.

Finally, it’s essential to remember that the structure and features of life insurance policies can vary significantly among insurers. To make an informed decision, compare options from different providers, read the Product Disclosure Statement (PDS) carefully, and consider seeking personalised advice from a financial advisor to determine the most suitable structure for your unique needs and circumstances.

Choose Morgan Insurance Brokers

Let Morgan Insurance Brokers take the stress out of finding the right life insurance policy for you. Our team of life insurance brokers will provide personalised guidance, whether you’re comparing term life and whole life insurance options or need help selecting a reputable provider.

We’ll navigate the intricacies of sourcing a policy tailored to your specific needs, ensuring you have the coverage you need to protect your family’s financial future.

With our deep understanding of the life insurance market, you can trust us to help you make informed decisions that offer you peace of mind and financial security.

Get a QuoteWhy Do You Need Life Insurance?

Life insurance is fundamentally about protecting your loved ones and securing what matters most. It provides a promise that those we care about will be supported financially if we are no longer able to provide for them. In times of emotional distress, it serves as a source of stability and reassurance for families facing challenging circumstances.

What is Life Insurance

Life insurance is a contract that provides financial protection for your loved ones in the event of your death. When you take out a policy, you pay regular premiums to an insurance company, which in return agrees to pay a lump sum, known as a death benefit, to your designated beneficiaries upon your passing.

This money can be used to cover various expenses, including mortgage payments to help your family stay in their home, everyday living costs such as groceries and bills, outstanding debts like loans or credit card balances, and funeral expenses to ease the financial burden of arrangements.

Life insurance is often regarded as a vital component of financial planning, particularly for individuals with dependants who rely on their income.

Term Life vs. Whole Life Insurance – Which One Should I Get?

Term life insurance provides coverage for a specific period, such as 5, 10, or 15 years. It pays a death benefit to your beneficiaries only if you pass away during the policy term. This type of insurance is generally more affordable than whole life insurance, especially for younger individuals. However, once the term expires, you need to renew it, often at a higher premium.

In contrast to term life insurance, whole life insurance is a permanent life insurance policy designed to provide coverage for the policyholder's entire life, up to a predetermined expiry age or until canceled by the policyholder. This type of insurance is typically more suitable for individuals seeking permanent, consistent coverage

When deciding on what type is insurance for you, here’s a list of questions to consider asking yourself –

- What are your key concerns or priorities when thinking about life insurance? (e.g. affordability, long-term coverage, leaving an inheritance)

- Do you have dependents who depend on your income? (e.g. spouse, children)

- Do you have substantial financial obligations? (e.g. mortgage, debts)

Keep in mind that the ideal type of life insurance varies based on your individual needs and circumstances. Consulting a financial advisor can help you evaluate the advantages and disadvantages, enabling you to make a well-informed choice.

When Should You Buy Life Insurance?

While the concept of life cover is straightforward, not all policies are created equal. Here are a list of factors to consider when selecting life cover and establishing your policy.

Age and Health Status

Premiums are generally lower when you’re younger and in good health. Non-smokers may also qualify for lower rates. Some policies for seniors may not require a medical exam.

Dependents

Consider whether you have dependents, like a spouse or children, who rely on your income. Life insurance can replace your income and provide financial security for them in the event of your passing.

Financial Obligations

Assess your current financial responsibilities, such as a mortgage, credit card debt, and living expenses. Life insurance can help cover these obligations if you were to die or become terminally ill.

Life Events

Major life milestones, such as buying a home, getting married, or starting a family, often increase financial responsibilities. Life insurance can serve as a safety net during these transitions.

Existing Insurance Coverage

Check if you have coverage through your superannuation fund or other policies. You may be able to increase your cover through your super fund. If switching super funds, verify your coverage options, especially if you're over 60 or have pre-existing conditions.

Policy Features and Costs

When comparing policies, consider benefits, coverage terms, exclusions, waiting periods, premium costs, and the potential for future increases. Always read the Product Disclosure Statement (PDS) carefully to understand what is covered and any limitations.

How Morgan Insurance Brokers Can Help

Let Morgan Insurance Brokers find and manage the ideal life insurance policy for you. Whether you're weighing the options between term life and whole life insurance or need assistance choosing a provider, our life insurance experts are dedicated to delivering personalised solutions tailored to your needs.

We handle all the complexities of sourcing a life insurance policy, allowing you to relax and enjoy the peace of mind it provides. With our extensive industry knowledge, you can feel confident that you’re making informed choices for your financial security

Get a Quote

Is It Good To Invest In Life Insurance?

Life insurance is primarily a safety net rather than a traditional investment aimed at generating financial returns. Its main purpose is to provide peace of mind, ensuring financial security for your loved ones. Although some policies may include a cash value component, this is less common in Australia, with a greater emphasis placed on the death benefit.

When considering whether life insurance is suitable for you, take into account factors such as whether you have dependents who rely on your income, the amount of debt you carry, and your overall financial goals. There are various types of life insurance available, each designed to meet specific needs.

Why Should You Invest In Life Insurance?

Determining whether life insurance is a worthwhile investment depends on your individual circumstances, priorities, and financial goals.

When Life Insurance Makes Sense –

Financial Dependents

If you have a spouse, children, ageing parents, or others who rely on your income, life insurance is often crucial. It replaces your income, helping them maintain their standard of living and cover essential expenses.

Debt Management

Life insurance can prevent your debts from becoming a burden on your family. The death benefit can be used to pay off mortgages, loans, and credit card balances.

Future Planning

Life insurance can assist in achieving financial goals for your family, such as funding education, leaving an inheritance, or supporting a charitable cause.

Factors Affecting Value –

Age and Health

Younger, healthier individuals typically pay lower premiums, making life insurance more cost-effective over time. As you age, premiums rise, and pre-existing health conditions can increase costs.

Lifestyle

Factors such as smoking, high-risk occupations, or dangerous hobbies can lead to higher premiums, affecting the overall value of the policy.

Policy Type

Different types of life insurance (e.g., term, whole life) come with varying costs and benefits. It’s essential to assess which type aligns best with your needs and budget.

Alternatives To Consider –

Savings and Investments

If your main goal is to build wealth, traditional investment options may be more appropriate. However, these come with market risks, unlike the guaranteed payout of a life insurance policy.

Superannuation-Linked Insurance

Many Australian superannuation funds provide life insurance as a group benefit, often at lower premiums compared to individual policies. However, these group policies may lack customization and flexibility.

Understanding the complexities of life insurance—such as the various policy types, coverage levels, and potential tax implications—can be difficult. It’s advisable to consult a financial advisor for personalised guidance tailored to your specific financial situation and goals. They can assess whether life insurance is a beneficial part of your overall financial strategy and help you identify the most suitable options.

How To Decide If Life Insurance Is Right For You?

Step 1: Assess Your Needs

Begin by carefully analysing your current situation. Consider your financial obligations, such as mortgages, loans, or credit card debts, and evaluate your family circumstances, particularly if you have dependents who rely on your income. It is also important to review any existing insurance coverage you may already have. This initial assessment will help you understand your specific needs.

Determine whether the default coverage provided by your superannuation fund is sufficient. Many people overlook this aspect, so it’s crucial to assess whether you need additional insurance to adequately protect your loved ones.

Step 2: Explore Your Options

Once you’ve assessed your needs, the next step is to explore your options. If you choose to consider life insurance within your superannuation, do not simply accept the default coverage. Instead, take the time to compare it with other policies available in the market. Pay attention to factors such as coverage limits, benefit payouts, and any additional features that may enhance your protection.

Step 3: Seek Expert Advice

Consulting an advisor or broker is essential for making informed decisions about life insurance products. An advisor can provide personalised insights and help you understand the pros and cons of various options in relation to your policy. This guidance is invaluable in ensuring that you select a policy that aligns with your specific needs.

Step 4: Conduct Regular Reviews

Life is ever-changing, making it vital to conduct regular reviews of your insurance coverage. This ensures that your policy remains aligned with your evolving needs. Major life events, such as family growth, asset acquisition, or changes in health, can significantly alter your insurance requirements. Regular assessments will help you adjust your coverage accordingly.

Let Morgan Insurance Brokers Help You Find The Best Policy

Let Morgan Insurance Brokers simplify your search for the right life insurance policy. Our expert team will provide personalised guidance, whether you’re comparing term life and whole life options or selecting a reputable provider.

Get a QuoteIs it Worth Having Income Protection Insurance?

Is It Worth Having Income Protection Insurance?

Income protection insurance offers a tax-free monthly income replacement if you are unable to work due to injury or medical reasons. This coverage includes benefits for both mental health issues, like stress-related conditions, as well as physical ailments such as back pain, cancer, or stroke.

You may be thinking “is income protection insurance really worth it?” Well, with income protection insurance, you gain peace of mind knowing that you have a financial safety net to cover your bills during periods of illness or injury. Depending on the policy, coverage continues until you either return to work or reach retirement age.

Here’s how it works –

Coverage – The insurance typically covers up to 70% of your pre-tax income. However, some insurers may have a monthly cap on the maximum amount they pay out.

Waiting Period – There’s a waiting period between when you become unable to work and when the payments begin. Longer waiting periods often result in lower premiums.

Benefit Period – The benefit period is the length of time the insurance company will provide payments, usually ranging from two to five years or until you reach a certain age, like 65.

Premiums – The cost of premiums depends on factors such as your age, occupation, health, lifestyle, the coverage amount you choose, the waiting period, and the benefit period.

Exclusions – The insurance doesn’t typically cover situations like deliberate self-harm, suicide attempts, normal pregnancy and childbirth, war, or criminal activities.

Get a QuoteWhen is it Worth it?

Here are some scenarios where income protection insurance is worth considering –

When you have limited savings and/or dependents

If you have limited savings and people who rely on your income, income protection insurance can help maintain financial stability and cover essential expenses like rent or mortgage payments, groceries, utility bills, etc.

When you are self-employed or a casual worker

If you are self-employed or a casual worker without access to sick leave or paid time off, income protection insurance becomes even more critical. It replaces the income you would lose due to an illness or injury, ensuring you can still manage your financial obligations.

According to the Australian Bureau of Statistics (ABS) as of August 2023, there are 1 million independent contractors in Australia who may not have access to sick leave. Additionally, 2.7 million employees (22% of all employees) are not entitled to paid leave. These figures highlight significant aspects of the Australian workforce and their working conditions and how income protection insurance can play a vital role in protecting the workers of Australia.

Get a QuoteWhen you have debts and financial obligations

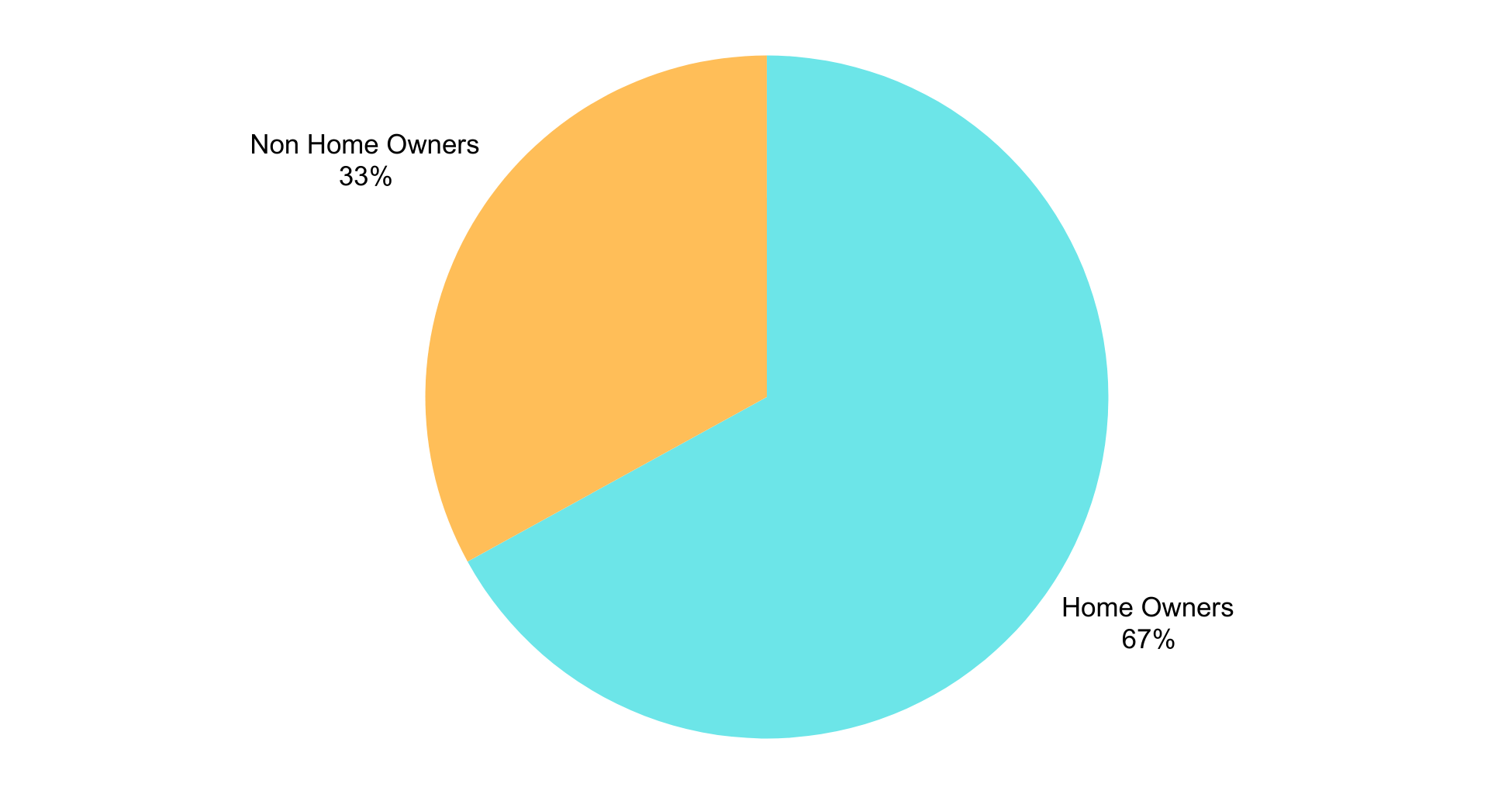

If you have major financial obligations such as a mortgage or rent, car loans, or credit card debt, income protection insurance can help you stay on top of your repayments. It provides a financial buffer, reducing the risk of defaulting on your loans and potentially facing financial difficulties. According to the Australian Bureau of Statistics (ABS), 66% of Australian households own their home, either outright or with a mortgage. This high rate of homeownership shows the importance of income protection insurance. For homeowners, maintaining mortgage payments is crucial to avoid financial distress or even foreclosure in the event of an unexpected illness or injury.

When you work in a high-risk occupation

If your job involves physical labour, operating machinery, or other high-risk activities, the chances of work related injuries are higher. Income protection insurance can be beneficial in such occupations, offering financial support during recovery.

When is it No Longer Worth it?

While income protection insurance offers valuable financial security, there are certain situations that make it less of a priority.

Sufficient savings and low expenses

If you have a sufficient emergency fund or minimal expenses, and can manage financially for an extended period without your regular income, income protection might be less crucial. This is particularly relevant if you have low or no debts and have no dependents.

Nearing retirement with ample savings

If you’re nearing retirement and have substantial savings, income protection will seem less appealing. Instead of paying premiums, you might choose to retire early if faced with a sudden health event, choosing to utilise savings for financial support.

Low-income earners

If you’re a low income earner, you might not find income protection insurance appealing compared to other types of insurance like Total & Permanent Disability insurance insurance which offers a payout if you are permanently unable to work, regardless of your earnings. This is because income protection insurance often replaces a portion of your income which might not be substantial for low-income earners.

Why Choose Morgan Insurance Brokers?

At Morgan Insurance Brokers, our team brings extensive experience, knowledge, and expertise in the insurance industry.

We recognise that obtaining the right income protection insurance can be challenging, particularly when looking for thorough coverage from a reliable provider. That’s why we’re committed to identifying the best coverage and pricing that fits your individual requirements. With connections to major insurers, our experts are here to help you navigate your choices and make an informed decision.

Our aim is to assist you in managing your rent or mortgage, handling everyday expenses, and ensuring you don’t have to depend on friends, family, or other sources for financial aid.

Get a QuoteWho Should Get Income Protection Insurance?

Income Protection Insurance in Australia acts as a financial safety net, offering peace of mind by providing income replacement if you can’t work due to illness or an injury. It’s important to note that this insurance covers a broad spectrum of health conditions, not just those related to accidents.

A few key characteristics of income protection insurance include:

- It replaces a portion of your income, usually up to 70% before tax.

- The payout is provided in regular monthly installments.

- It can be used to cover various financial needs, including medical bills, mortgage payments, utility bills, and even ongoing insurance premiums.

- It offers flexibility and customisation for you to tailor the policy to your needs and budget.

- It is especially crucial for self-employed individuals who lack access to employer-provided sick leave or disability benefits.

It is essential to understand that the cost of income protection insurance varies depending on factors like your age, occupation, health, chosen coverage amount, and the specific policy terms.

Occupations are categorised by risk levels; for instance, a construction worker would generally pay higher premiums than an office worker due to the higher risk associated with their profession. Policies covering a larger percentage of your income or offering a shorter waiting period comes with higher premiums.

Do you Need Income Protection Insurance?

When evaluating your need for income protection insurance, several factors come into play. Some of the factors to consider when determining if you require income protection insurance include:

-

Your employment status

If you are self-employed or work as a freelancer or contractor, chances are that you lack access to paid sick leave and annual benefits that are typically offered by employers. In such cases, income protection insurance becomes crucial in serving as a financial safety net during times of illness or injury.

-

Do you have dependents?

If you have family members or dependents who rely on your income for support, income protection insurance can provide peace of mind, knowing that their financial well-being is protected even when you cannot work.

-

Do you have savings?

Carefully assess the amount of savings you have or other funds to cover household bills and living expenses. If your savings seem insufficient to sustain your lifestyle for an extended period, income protection insurance helps bridge that financial gap while recovering from illness or injury.

-

Do you have existing debt obligations?

Do you have regular debt payments such as mortgage, utility bills, or other loans? If so, income protection insurance can help ensure you meet these financial obligations without risking default or financial hardship.

-

What is your personal risk tolerance?

Do you have an understanding of your capacity to manage financial uncertainty and income loss? Income protection insurance provides a safety net, allowing you to focus on recovery without the added burden of financial worries.

Alongside asking yourself these questions, it is important to create a personalised budget to gain a clearer picture of your monthly expenses and the income you might need to replace if you can’t work. This will help you determine the appropriate level of coverage you might need.

Which Premium Type is Right for me?

When choosing a premium type for income protection insurance, you will likely have the choice of stepped or level premiums. The choice you make will impact how much you pay now and in the future.

Stepped Premiums

These are recalculated at each policy renewal, and it is likely that at each renewal your costs will increase as you age and become more prone to illnesses. However, they are generally cheaper in the early years of the policy.

Level Premiums

These are not based on the policyholder’s age. They charge a higher premium at the start of the policy, but the cost changes over time and increases are not based on age.

The choice on which type of premium to choose is completely up to you. Morgan Insurance Brokers will help provide you general advice on making this decision but it is up to you to evaluate your personal and financial needs in deciding what’s best for you.

Why Choose Morgan Insurance Brokers?

At Morgan Insurance Brokers, we’ve recently added income protection insurance to our range of services because we know exactly how crucial it is to safeguard your financial future during rainy days.

Our team is committed to securing the ideal coverage for you at the best price and customised to meet your individual needs. With access to over 150 insurers, our skilled brokers will guide you through your options and help you make well-informed decisions.

Get a QuoteWhat income protection does not cover?

Income Protection Insurance in Australia acts as a financial buffer, offering a replacement income stream for individuals who are unable to work due to illness or injury. Instead of directly replacing lost income, it provides a monthly benefit, typically up to 70% of the insured person’s pre-tax income.

This benefit helps you manage a variety of financial commitments, from daily living expenses and medical bills to mortgage repayments and insurance premiums.

This safety net ensures that individuals can prioritise their recovery without the added burden of financial strain. It provides a sense of security, allowing individuals to focus on regaining their health while maintaining their financial stability and meeting their financial obligations. Like most insurance coverages, it acts as a personal rainy day safety net.

What does it Include?

Each income protection policy has a definition of partial or total disability that must be met before a claim can be made, and it is important to check with your insurer for their specific definitions.

Some of the most common things that income protection insurance cover includes:

- Injuries or illnesses that prevent you from working, as long as they are not listed as a specific exclusion in your policy.

- A percentage of your regular income while you are unable to work, allowing you to cover your living expenses.

Additionally, many policies offer coverage for rehabilitation services and ongoing medical treatments, providing a more inclusive safety net during your recovery period.

What income protection does not cover?

While income protection insurance acts as an essential safety net for individuals in cases of injury, and illnesses it does not cover everything. Pre-existing conditions, self-inflicted injuries, criminal activitiies, risky activities, elective surgery, and unemployment are the main circumstances that income protection does not cover. It’s important to note that just like most insurance policies, income protection insurance has its own list of exclusions too.

Here’s a list of the most common exclusions of what income protection does not cover:

Pre-existing medical conditions

Many income protection plans have limitations or exclusions related to pre-existing medical conditions. It’s essential to disclose any pre-existing conditions when applying for coverage, as failure to do so could result in a claim being denied.

Self-inflicted injuries

Intentionally self-inflicted injuries are excluded to prevent misuse of coverage. However, some providers may cover injuries resulting from a mental condition.

Pregnancy and Birth

Income protection insurance typically excludes coverage for normal pregnancy and childbirth. This means that any time off work due to these reasons won't be compensated under such policies, including maternity leave. You can refer to the governments fairwork policy on parental leave to determine if you are eligible for maternity or paternity leave entitlements.

Acts of war and terrorism

Income protection typically excludes injuries or illnesses resulting from war, as these situations are too unpredictable and broad for standard insurance coverage.

Criminal activities

Participation in illegal activities typically will lead to exclusion from coverage for any resulting injuries or illnesses.

Risky activities

Income protection policies may exclude coverage for injuries or illnesses sustained while participating in activities deemed risky. However, what is specifically classified as ‘risky’ will vary between insurance providers.

Unemployment

Situations related to job loss such as seasonal, self-administered, or the end of a fixed-term contract unemployment are typically not covered.

Voluntary elective surgery or treatment

Many insurance policies exclude or limit coverage for elective surgeries and non-emergency treatments. This means procedures that aren't medically necessary might not be covered.

It’s crucial to thoroughly review the terms and conditions of any income protection policy to understand the specific exclusions and limitations. Seeking advice from insurance brokers can be helpful in understanding these details and selecting the most appropriate coverage for you.

Why Choose Morgan Insurance Brokers?

At Morgan Insurance Brokers, our team brings extensive experience, knowledge, and expertise to the insurance industry.

Navigating the complexities of income protection insurance can be challenging, especially when seeking comprehensive coverage from a reliable source. We actively work to secure the best coverage at the right price, tailored specifically to your needs. Morgan Insurance also provides ourselves on education. We like to educate our clients on such topics such as what income protection does not cover.

We have recently expanded our services to include income protection insurance because we recognise the critical importance of protecting your income during challenging times. This coverage helps ensure you can meet your rent or mortgage payments, manage expenses, and avoid relying on friends and family.

Get a Quote