Comparing Income Protection Insurance

When searching for Life Insurance, Total and Permanent Disability (TPD), Trauma, and Income Protection insurance, the cost is just one factor to consider. Different insurance companies may offer better rates depending on your age and occupation. However, the terms offered by different insurers can be even more crucial, especially when it comes to income protection or TPD cover.

Occupation Ratings and Terms Differ Across Insurers

When it comes to insurance, your occupation plays a crucial role in determining your overall risk and the premiums you pay. Insurance companies use your job as a key factor in their risk assessment process, which not only influences your premiums but also the specific terms of your insurance contract.

For instance, if you are a ‘White Collar’ worker, some insurance companies may allow you to return to work from day one following a disability or illness without affecting your ‘waiting period.’ This means you can continue working without having to wait for a certain period before your insurance benefits kick in. On the other hand, some super funds have stricter requirements. They may stipulate in their product disclosure statements that ‘White Collar’ workers must experience 14 days of total disability before they are eligible to make a claim under their income protection products. If this condition is not met, your claim could be denied.

Underwritten Cover

Another important consideration is whether you have underwritten insurance cover.

Underwritten cover refers to an insurance policy that has been fully assessed and approved by the insurance company based on your individual risk factors. This process involves a thorough evaluation of your personal information, such as your health, occupation, lifestyle, and medical history. Here’s why underwritten cover is important:

Greater Certainty and Stability

When you have a fully underwritten insurance policy, it means that the terms of your contract are fixed and agreed upon at the time of underwriting. This provides greater certainty because the insurance company cannot change the terms of your policy later on. You can rely on the definitions and conditions outlined in the product disclosure statement that was in effect when you took out the policy.

Default Cover

In contrast, a default insurance contract (often offered automatically through your super fund) may be subject to changes as the product disclosure statement of your provider evolves over time. It’s important to note that the same insurance company may provide different versions of their product disclosure statement depending on whether you apply for cover directly with the insurance company or via a third-party offering, such as a super fund.

General Advice

The information in this blog contains general information only. We have not taken into consideration any of your personal objectives, financial situation, or needs. Before taking any action, you should consider whether the general advice contained in this blog is appropriate for you, having regard to your situation or needs. We recommend consulting a licensed or authorised financial adviser if you require financial advice that takes into account your personal circumstances.

Morgan Insurance Advisors Pty Ltd is an Authorised Representative (ASIC No 319449) of HAE Financial Pty Ltd AFSL 501891.

Why Income Protection Might Be a Better Choice Than Workers Compensation

When it comes to securing your financial well-being, it's crucial to understand the differences between Income Protection insurance and Workers Compensation. While both are designed to provide financial support in the event of an injury or illness, Income Protection often offers more comprehensive coverage. Here's a deeper dive into why Income Protection might be the better option for you:

Comprehensive Coverage

Income Protection insurance is designed with flexibility in mind. It pays out benefits regardless of where the sickness or injury occurs—whether at work, at home, or anywhere else. This means that if you fall ill or get injured while on vacation, during a weekend hike, or even while doing household chores, you can still receive financial support. The specifics of the coverage will depend on your policy details and the type of cover you choose, but the overarching benefit is clear: you're protected in a wide range of scenarios.

State-Specific Limitations of Workers Compensation

Workers Compensation is a state-regulated benefit, meaning the rules and coverage can vary significantly depending on where you live. For example, in New South Wales (NSW), Workers Compensation is only payable if there is a real and substantial connection between your employment and the accident or incident that caused the injury. This can sometimes make it difficult to qualify for benefits, especially if the injury occurs outside of work hours or in situations not directly related to your job.

Financial Risks of Relying Solely on Workers Compensation

The narrow terms applied to Workers Compensation policies can leave many Australians vulnerable. Since the majority of accidents and injuries occur at home or during leisure activities, relying solely on Workers Compensation for financial protection can be risky. If an injury happens while you're gardening, playing sports, or simply enjoying a day off, Workers Compensation may not cover you. This gap in coverage can lead to significant financial hardship, especially if you're unable to work for an extended period.

The Broader Safety Net of Income Protection

Income Protection insurance provides a broader safety net, ensuring that you're covered in more situations. This type of insurance is designed to replace a portion of your income if you're unable to work due to illness or injury, regardless of where or how it happens. This can be particularly reassuring for those who engage in activities outside of work that carry a risk of injury. By having Income Protection, you can focus on your recovery without the added stress of financial instability.

While Workers Compensation has its place and can be beneficial for work-related injuries, it has limitations that can leave you exposed. Income Protection, with its broader coverage and flexibility, offers a more comprehensive solution. It ensures that you're protected in a variety of scenarios, helping to prevent financial disaster and providing peace of mind. When considering your options, it's essential to evaluate your lifestyle and the potential risks you face, ensuring you choose the coverage that best meets your needs.

Get a QuoteIs it Worth Having Income Protection Insurance?

Is It Worth Having Income Protection Insurance?

Income protection insurance offers a tax-free monthly income replacement if you are unable to work due to injury or medical reasons. This coverage includes benefits for both mental health issues, like stress-related conditions, as well as physical ailments such as back pain, cancer, or stroke.

You may be thinking “is income protection insurance really worth it?” Well, with income protection insurance, you gain peace of mind knowing that you have a financial safety net to cover your bills during periods of illness or injury. Depending on the policy, coverage continues until you either return to work or reach retirement age.

Here’s how it works –

Coverage – The insurance typically covers up to 70% of your pre-tax income. However, some insurers may have a monthly cap on the maximum amount they pay out.

Waiting Period – There’s a waiting period between when you become unable to work and when the payments begin. Longer waiting periods often result in lower premiums.

Benefit Period – The benefit period is the length of time the insurance company will provide payments, usually ranging from two to five years or until you reach a certain age, like 65.

Premiums – The cost of premiums depends on factors such as your age, occupation, health, lifestyle, the coverage amount you choose, the waiting period, and the benefit period.

Exclusions – The insurance doesn’t typically cover situations like deliberate self-harm, suicide attempts, normal pregnancy and childbirth, war, or criminal activities.

Get a QuoteWhen is it Worth it?

Here are some scenarios where income protection insurance is worth considering –

When you have limited savings and/or dependents

If you have limited savings and people who rely on your income, income protection insurance can help maintain financial stability and cover essential expenses like rent or mortgage payments, groceries, utility bills, etc.

When you are self-employed or a casual worker

If you are self-employed or a casual worker without access to sick leave or paid time off, income protection insurance becomes even more critical. It replaces the income you would lose due to an illness or injury, ensuring you can still manage your financial obligations.

According to the Australian Bureau of Statistics (ABS) as of August 2023, there are 1 million independent contractors in Australia who may not have access to sick leave. Additionally, 2.7 million employees (22% of all employees) are not entitled to paid leave. These figures highlight significant aspects of the Australian workforce and their working conditions and how income protection insurance can play a vital role in protecting the workers of Australia.

Get a QuoteWhen you have debts and financial obligations

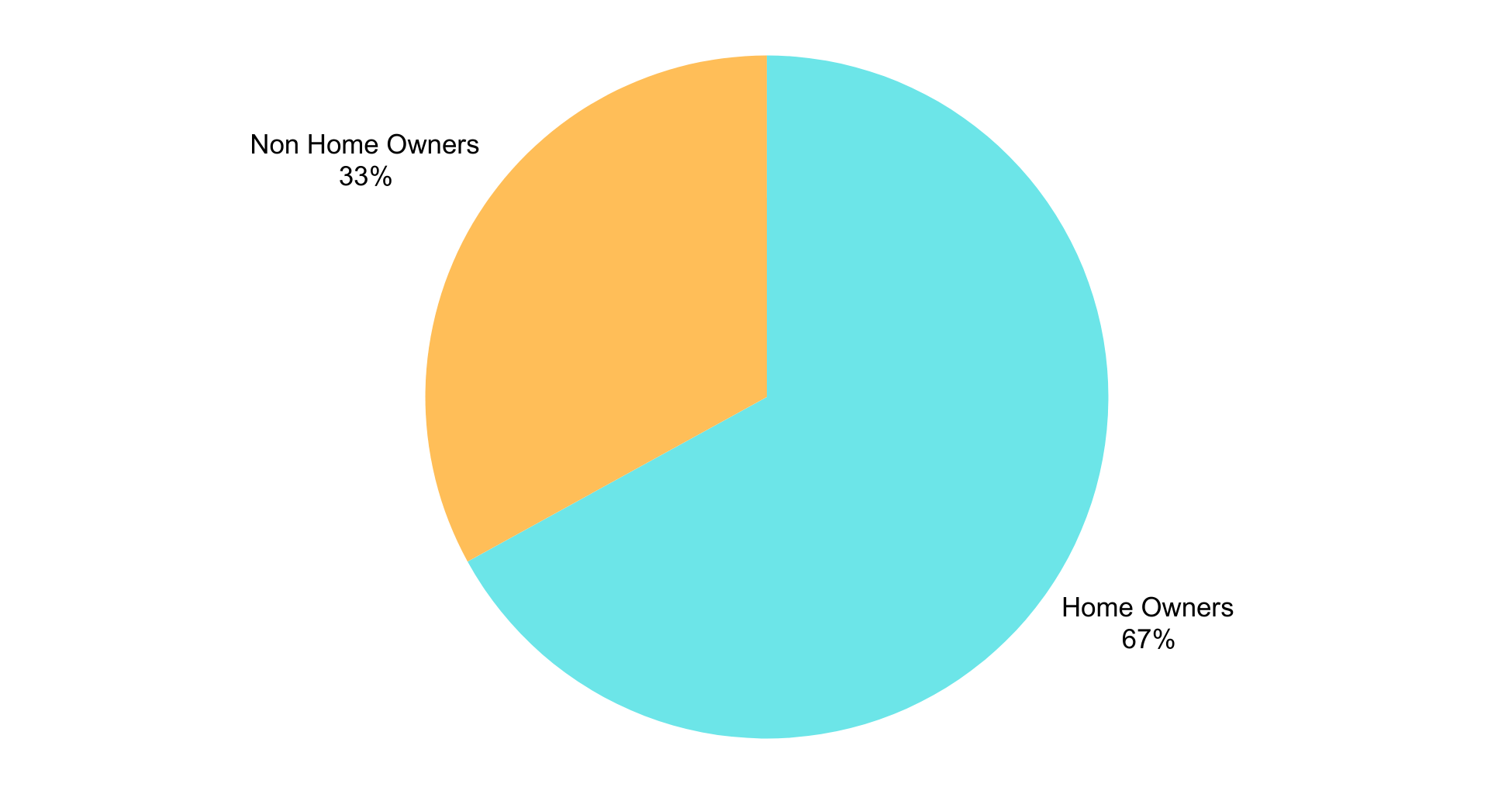

If you have major financial obligations such as a mortgage or rent, car loans, or credit card debt, income protection insurance can help you stay on top of your repayments. It provides a financial buffer, reducing the risk of defaulting on your loans and potentially facing financial difficulties. According to the Australian Bureau of Statistics (ABS), 66% of Australian households own their home, either outright or with a mortgage. This high rate of homeownership shows the importance of income protection insurance. For homeowners, maintaining mortgage payments is crucial to avoid financial distress or even foreclosure in the event of an unexpected illness or injury.

When you work in a high-risk occupation

If your job involves physical labour, operating machinery, or other high-risk activities, the chances of work related injuries are higher. Income protection insurance can be beneficial in such occupations, offering financial support during recovery.

When is it No Longer Worth it?

While income protection insurance offers valuable financial security, there are certain situations that make it less of a priority.

Sufficient savings and low expenses

If you have a sufficient emergency fund or minimal expenses, and can manage financially for an extended period without your regular income, income protection might be less crucial. This is particularly relevant if you have low or no debts and have no dependents.

Nearing retirement with ample savings

If you’re nearing retirement and have substantial savings, income protection will seem less appealing. Instead of paying premiums, you might choose to retire early if faced with a sudden health event, choosing to utilise savings for financial support.

Low-income earners

If you’re a low income earner, you might not find income protection insurance appealing compared to other types of insurance like Total & Permanent Disability insurance insurance which offers a payout if you are permanently unable to work, regardless of your earnings. This is because income protection insurance often replaces a portion of your income which might not be substantial for low-income earners.

Why Choose Morgan Insurance Brokers?

At Morgan Insurance Brokers, our team brings extensive experience, knowledge, and expertise in the insurance industry.

We recognise that obtaining the right income protection insurance can be challenging, particularly when looking for thorough coverage from a reliable provider. That’s why we’re committed to identifying the best coverage and pricing that fits your individual requirements. With connections to major insurers, our experts are here to help you navigate your choices and make an informed decision.

Our aim is to assist you in managing your rent or mortgage, handling everyday expenses, and ensuring you don’t have to depend on friends, family, or other sources for financial aid.

Get a QuoteWho Should Get Income Protection Insurance?

Income Protection Insurance in Australia acts as a financial safety net, offering peace of mind by providing income replacement if you can’t work due to illness or an injury. It’s important to note that this insurance covers a broad spectrum of health conditions, not just those related to accidents.

A few key characteristics of income protection insurance include:

- It replaces a portion of your income, usually up to 70% before tax.

- The payout is provided in regular monthly installments.

- It can be used to cover various financial needs, including medical bills, mortgage payments, utility bills, and even ongoing insurance premiums.

- It offers flexibility and customisation for you to tailor the policy to your needs and budget.

- It is especially crucial for self-employed individuals who lack access to employer-provided sick leave or disability benefits.

It is essential to understand that the cost of income protection insurance varies depending on factors like your age, occupation, health, chosen coverage amount, and the specific policy terms.

Occupations are categorised by risk levels; for instance, a construction worker would generally pay higher premiums than an office worker due to the higher risk associated with their profession. Policies covering a larger percentage of your income or offering a shorter waiting period comes with higher premiums.

Do you Need Income Protection Insurance?

When evaluating your need for income protection insurance, several factors come into play. Some of the factors to consider when determining if you require income protection insurance include:

-

Your employment status

If you are self-employed or work as a freelancer or contractor, chances are that you lack access to paid sick leave and annual benefits that are typically offered by employers. In such cases, income protection insurance becomes crucial in serving as a financial safety net during times of illness or injury.

-

Do you have dependents?

If you have family members or dependents who rely on your income for support, income protection insurance can provide peace of mind, knowing that their financial well-being is protected even when you cannot work.

-

Do you have savings?

Carefully assess the amount of savings you have or other funds to cover household bills and living expenses. If your savings seem insufficient to sustain your lifestyle for an extended period, income protection insurance helps bridge that financial gap while recovering from illness or injury.

-

Do you have existing debt obligations?

Do you have regular debt payments such as mortgage, utility bills, or other loans? If so, income protection insurance can help ensure you meet these financial obligations without risking default or financial hardship.

-

What is your personal risk tolerance?

Do you have an understanding of your capacity to manage financial uncertainty and income loss? Income protection insurance provides a safety net, allowing you to focus on recovery without the added burden of financial worries.

Alongside asking yourself these questions, it is important to create a personalised budget to gain a clearer picture of your monthly expenses and the income you might need to replace if you can’t work. This will help you determine the appropriate level of coverage you might need.

Which Premium Type is Right for me?

When choosing a premium type for income protection insurance, you will likely have the choice of stepped or level premiums. The choice you make will impact how much you pay now and in the future.

Stepped Premiums

These are recalculated at each policy renewal, and it is likely that at each renewal your costs will increase as you age and become more prone to illnesses. However, they are generally cheaper in the early years of the policy.

Level Premiums

These are not based on the policyholder’s age. They charge a higher premium at the start of the policy, but the cost changes over time and increases are not based on age.

The choice on which type of premium to choose is completely up to you. Morgan Insurance Brokers will help provide you general advice on making this decision but it is up to you to evaluate your personal and financial needs in deciding what’s best for you.

Why Choose Morgan Insurance Brokers?

At Morgan Insurance Brokers, we’ve recently added income protection insurance to our range of services because we know exactly how crucial it is to safeguard your financial future during rainy days.

Our team is committed to securing the ideal coverage for you at the best price and customised to meet your individual needs. With access to over 150 insurers, our skilled brokers will guide you through your options and help you make well-informed decisions.

Get a QuoteWhat income protection does not cover?

Income Protection Insurance in Australia acts as a financial buffer, offering a replacement income stream for individuals who are unable to work due to illness or injury. Instead of directly replacing lost income, it provides a monthly benefit, typically up to 70% of the insured person’s pre-tax income.

This benefit helps you manage a variety of financial commitments, from daily living expenses and medical bills to mortgage repayments and insurance premiums.

This safety net ensures that individuals can prioritise their recovery without the added burden of financial strain. It provides a sense of security, allowing individuals to focus on regaining their health while maintaining their financial stability and meeting their financial obligations. Like most insurance coverages, it acts as a personal rainy day safety net.

What does it Include?

Each income protection policy has a definition of partial or total disability that must be met before a claim can be made, and it is important to check with your insurer for their specific definitions.

Some of the most common things that income protection insurance cover includes:

- Injuries or illnesses that prevent you from working, as long as they are not listed as a specific exclusion in your policy.

- A percentage of your regular income while you are unable to work, allowing you to cover your living expenses.

Additionally, many policies offer coverage for rehabilitation services and ongoing medical treatments, providing a more inclusive safety net during your recovery period.

What income protection does not cover?

While income protection insurance acts as an essential safety net for individuals in cases of injury, and illnesses it does not cover everything. Pre-existing conditions, self-inflicted injuries, criminal activitiies, risky activities, elective surgery, and unemployment are the main circumstances that income protection does not cover. It’s important to note that just like most insurance policies, income protection insurance has its own list of exclusions too.

Here’s a list of the most common exclusions of what income protection does not cover:

Pre-existing medical conditions

Many income protection plans have limitations or exclusions related to pre-existing medical conditions. It’s essential to disclose any pre-existing conditions when applying for coverage, as failure to do so could result in a claim being denied.

Self-inflicted injuries

Intentionally self-inflicted injuries are excluded to prevent misuse of coverage. However, some providers may cover injuries resulting from a mental condition.

Pregnancy and Birth

Income protection insurance typically excludes coverage for normal pregnancy and childbirth. This means that any time off work due to these reasons won't be compensated under such policies, including maternity leave. You can refer to the governments fairwork policy on parental leave to determine if you are eligible for maternity or paternity leave entitlements.

Acts of war and terrorism

Income protection typically excludes injuries or illnesses resulting from war, as these situations are too unpredictable and broad for standard insurance coverage.

Criminal activities

Participation in illegal activities typically will lead to exclusion from coverage for any resulting injuries or illnesses.

Risky activities

Income protection policies may exclude coverage for injuries or illnesses sustained while participating in activities deemed risky. However, what is specifically classified as ‘risky’ will vary between insurance providers.

Unemployment

Situations related to job loss such as seasonal, self-administered, or the end of a fixed-term contract unemployment are typically not covered.

Voluntary elective surgery or treatment

Many insurance policies exclude or limit coverage for elective surgeries and non-emergency treatments. This means procedures that aren't medically necessary might not be covered.

It’s crucial to thoroughly review the terms and conditions of any income protection policy to understand the specific exclusions and limitations. Seeking advice from insurance brokers can be helpful in understanding these details and selecting the most appropriate coverage for you.

Why Choose Morgan Insurance Brokers?

At Morgan Insurance Brokers, our team brings extensive experience, knowledge, and expertise to the insurance industry.

Navigating the complexities of income protection insurance can be challenging, especially when seeking comprehensive coverage from a reliable source. We actively work to secure the best coverage at the right price, tailored specifically to your needs. Morgan Insurance also provides ourselves on education. We like to educate our clients on such topics such as what income protection does not cover.

We have recently expanded our services to include income protection insurance because we recognise the critical importance of protecting your income during challenging times. This coverage helps ensure you can meet your rent or mortgage payments, manage expenses, and avoid relying on friends and family.

Get a QuoteWhat does Income Protection Insurance Cover?

Within Australia, Income Protection Insurance is a financial safety net designed to replace a portion of an insured individual’s income if they become unable to work due to illness or injury. Income protection insurance provides regular monthly payments, typically replacing up to 70% of the insured person’s pre-tax income.

These payments help cover essential living expenses, ensuring financial security and stability during the recovery period. As an individual with income protection insurance, in the event of an unfortunate event, you can still maintain your financial obligations whilst focusing on recovery without the added stress of lost income.

How does Income Protection Insurance Work?

With an income protection insurance policy in place, you can help ensure that you and your loved ones will not be left with a major financial burden if you were to lose your income. The benefit payment can be used for various daily, monthly, and unexpected expenses including:

- Rent and mortgage payments

- Ongoing bills and everyday miscellaneous expenses

- Medical and rehabilitation costs

- Transportation costs

- The insurance premium itself

To understand how income protection insurance works, it’s important to know the key aspects of its operations.

Waiting Period

When you first purchase an income protection insurance policy, you have the option to choose a waiting period. This period represents the time you need to wait after becoming unable to work due illness or injury before your insurance benefits begin.

The waiting periods usually range from 30 days to two years, with shorter periods generally leading to higher premium costs. You can choose to tailor this to your financial capacity and savings, allowing you to manage expenses until the insurance payment commences.

Benefit Period

This refers to the duration for which the insurance will continue paying out benefits while you are unable to work. This can vary significantly depending on your chosen policy. Choosing an appropriate benefit period requires considering career longevity and potential health risks to ensure continuous financial coverage.

Claims & Payouts

If you experience an illness or an injury that prevents you from working, you would typically file a claim with your insurance provider. Once the waiting period you selected elapses, and your claim is approved, you will begin receiving monthly payments, typically up to 70% of your pre-tax income. These payments can be used to cover various financial obligations.

In essence, it operates as a financial safety net, providing you with income during times you are unable to earn due to health reasons.

What Specific Expenses are Covered?

Income protection insurance not only helps individuals cover the commitments listed below but also enables them to maintain their overall financial health by supporting their ability to save and invest during periods of income loss.

Day-to-day living expenses

This would include everyday costs of living, such as groceries, utilities, and transportation.

Medical and rehabilitation expenses

These costs can quickly add up and include doctor’s appointments, treatments, and therapies.

Mortgage and other debt repayments

Income protection benefits can help to prevent falling behind on loans for a house or car, as well as credit card payments.

Insurance premiums

This ensures the continuation of coverage from the policy during the benefit period.

This support is designed in such a way that it empowers individuals to focus on their recovery without the added stress of financial burdens.

What does it Not Cover?

Here’s a list of what income protection insurance does not cover:

- Some pre-existing medical conditions

- Injuries caused by self-harm

- War and terrorist activities

- Illegal activities

- High-risk behaviours

- Job loss

Always remember to thoroughly read and understand exactly what your policy stipulates before making a decision to purchase. Our brokers can help you navigate the complexities involved to make the most informed choice and secure coverage that best policy that meets your needs.

Why Choose Morgan Insurance Brokers?

At Morgan Insurance Brokers, we are a team of professionals with a wealth of experience, knowledge, and skill in the field of insurance.

As someone seeking income protection insurance, we understand how it might be complex to get all the coverage you need from a single, trusted source. Hence, we make it our mission to find the best coverage at the right price for your specific requirements. Our team of experienced brokers work with over 150 insurers, ensuring that you understand your options and can make an informed decision.

We recently expanded to include income protection insurance as part of our service offerings. We recognise the importance of safeguarding your income in times of hardship so that you can keep up with your rent or mortgage payments, daily expenses, as well as not rely on friends, family, or other third parties for financial support.

Get a Quote