Tips on How to Protect Your Business From a Cyber Attack

Tips on How to Protect Your Business From a Cyber Attack

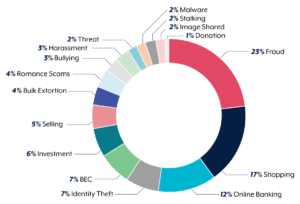

During the 2020–21 financial year, over 67,500 cybercrime reports were made, an increase of nearly 13 per cent from the previous financial year. One cybercrime report is made approximately every eight minutes in Australia.

Questions to ask yourself:

What procedures does your business currently have in place if you were to be at the receiving end of a cyber attack?

What would be the impact on your business if you were unable to use your computers for a period of time?

Do you have funds readily available to engage an IT company to handle the recovery of your data, including the forensic and crisis response costs?

Here are 8 essential actions that businesses should take to improve their cyber security procedures

Download Malware/Virus Protection on all devices.

All anti-virus software is not created equal – often it’s a case of you get what you pay for. Consider upgrading from traditional AV software to EDR (Endpoint Detection & Response), which can protect your devices from hacking as well as viruses and malware. This level of software has only recently been affordable at the SME level. And remember – MacOS devices are NOT immune to viruses… They must have protection as well!

Multi-Function Authentication

Activate Multi-Function Authentication (MFA) on all accounts (particularly email/cloud file storage) – MFA is a significant step to protect your accounts from hackers. Without MFA your account can be accessed with only your username and password, and there is any number of ways these can be compromised.

Check that your software is up to date

Check that all your software patches are up to date – suppliers are constantly fixing software vulnerabilities that have been discovered by releasing “patches” or “updates”. Whenever your device is running out-of-date software, it is at risk of attack.

Take Backups of your system

Make sure that you have regular backups of critical files – Backup, backup, BACKUP! Using a cloud storage system for your files does not mean that your files are safe. Always use a secondary backup method.

Password Management System

Use a Password Management system – These make life much easier with the never-ending list of passwords we have these days! They allow you to quickly generate secure passwords without using the same one again and again (a big no-no!), and they also store them securely while allowing easy access from all your devices.

Education

Staff training and education on cyber procedures –

Say you’ve followed all of the above, only to have an employee click a phishing email and open your network up to an attack. Having employees that can spot emails that aren’t genuine can prevent a phishing attack. Businesses should also implement procedures to call clients to confirm bank account details before raising payments. This can prevent money from ending up in the wrong hands.

Cyber Insurance

Purchase a Cyber Insurance policy –

A Cyber Insurance policy can cover the costs of an attack on a business, including the costs of a ransomware request, business Interruption costs, IT costs associated – such as restoration of data, and costs incurred for your client’s personal information being breached, such as regulatory penalties.

Prevention

Prevention is Key! Engage a professional to do an assessment of your Cyber Security. Cyber Insurance is there for you after an attack, but engaging Frontline Cyber Security to conduct a Cyber Security assessment of your IT installation could prevent an attack altogether.

“Jack Richards from FrontLine CyberSecurity – IT expert specialising in protecting and recovering SME’s from cyber security disasters – “If your business relies on your IT system to function, then you cannot afford NOT to have the best support and protection in place”

These are just a few basic (but important) steps to help keep your data safe.

Confused by any of this terminology? If so, then a review of your IT measures is extremely important to prevent an attack on your business.

Hackers attack humans, not computers, and we can make mistakes, no matter how protected our computer is. All it takes is a click of a button for your business to be a victim.

A Cyber Insurance policy can protect you from the financial burden of a cyber-attack.

Safeguard your business by implementing the 8 tips mentioned today.

Let us help you get the best business insurance, contact us today for a quick quote.

Lauren was amazing to work with so much on going help was awesome. Highly recommend using the services on offer. 10 stars **********

Peter Stapleton

Lauren Spice did a great job at finding multiple insurance products at short notice – she worked on it instantly and got the job done efficiently and professionally provide options not just one quote.

Jesse Murphy

Lauren did an excellent job in accessing appropriate insurance for my medical services company. Responded to my first email in the middle of the night. Rare to get such efficient service these days

Jonathan Ramsay

Lauren was awesome helping us to sort out our insurance incredibly quickly. Called her urgently in the morning as we needed the insurance by 5pm on the same day and she had organised a series of quotes and recommendations within a couple of hours. Would highly recommend her!

Rommo Pandit

I dealt with Lauren and she was fantastic. She’s very knowledgable and had all the answers. Would recommend reaching out to her if you need anything insurance related.

Steven Pretty

I have dealt with Lauren from MIB insurance for the last 3 years. Lauren’s attention to detail is incredible and she goes above and beyond in finding the best insurance cover for our business. I can not recommend Lauren highly enough. She has recently insured our second business as well. I recommend MIB to all of my business colleagues.

David Glenister

Lauren has been so helpful, accessible and efficient, helping us to insure our first home!

Maddie Humphrey

The very best insurance services!

Pete Smith

OUR PROCESS

Get a Cyber Insurance quote in just 3 easy steps

Let us do what we do best, so you can get back to doing what you do best. Have trust knowing that we have the knowledge and expertise to provide you with insurance that’s going to protect your assets.

01

Tell us about yourself

Let us get to know you and your business.

02

Choose a tailored policy

Review your personalised and tailored insurance program.

03

Get Insured

Place cover knowing that you’re insured with an approved provider and a dedicated broker on your side.

Tips on how to save money on your Commercial Motor Insurance

Motor insurance is one of the must-have insurances for all individuals and businesses. The statistics on car accidents make it clear that it's an insurance policy that you must have to avoid the financial burden of a car accident. But with the ever-increasing costs of living, running a business, and insurance, reducing your insurance premiums without sacrificing cover is a must.

How are motor insurance premiums calculated?

The insurers have rating metrics that they use to determine the cost of a motor vehicle insurance policy.

These factors include:

- The vehicle itself - the year, make and model - certain vehicles are more expensive to repair, others are riskier with performance engines

- The value of the vehicle - how much they would have to pay to replace the vehicle if it were written off

- The garaging address - the overnight address plays a role in determining the insurance premium as your postcode could have higher claim statistics (thefts, storms)

- The driver - The driver's age and driving history also weigh heavily in calculating insurance premiums - young drivers are particularly costly

All of the above are the main factors that the insurers use in calculating the cost of your insurance.

Reviewing your vehicle value

On a Commercial Motor Vehicle policy where you are insuring your truck, rigid vehicle, or prime mover for example, you will note that you have to select an amount that you insure your vehicle for. This amount is usually close to the market value of your vehicle. However, if you have not reviewed your vehicle value on your policy in quite some time, it's best that you do some research to determine if the amount your vehicle is insured for reflects the true value of your vehicle. You will note on your insurance policy that your vehicle could be insured for $XXX, "OR Market value - whichever is the lesser". What this means is that even though you have elected $XXXX to insure your vehicle, if you were to write your vehicle off, the insurer will only pay up to the market value if the figure of $XXX is higher than the market value. As there would be no rebate if you insured your vehicle for higher than the market value, it's important to review this figure annually. You can reduce your insurance premiums by ensuring that your vehicle value decreases on your policy to match depreciation.

NSW Stamp Duty Exemption

In NSW, if you are a small business turning over less than $2,000,000 you may be eligible for the NSW Stamp Duty Exemption. If eligible, this can be applied to your Commercial Motor Vehicle Insurance. This can reduce your premiums by close to 10%

To see if you are eligible for the NSW Stamp Duty Exemption, please refer to

Revenue NSW website:

- Revenue NSW “Small Business Exemption” heading in Frequently Asked Questions – http://revenue.nsw.gov.au/info/legislation/budget/201706/faq

- Insurance Duty- http://www.revenue.nsw.gov.au/taxes/insurance/factsheet/overview

Increasing your excesses

An excess is an amount you have to pay if you make a claim on your insurance policy. It’s a way of you sharing a small portion of the costs with the insurer. On most Commercial Motor policies the standard excess is usually $600. For larger higher value vehicles, you could see that your excess is 1% of the sum insured. Increasing your excess could reduce your premiums.

Adjusting your radius limit

The radius at which your vehicle is insured under your policy can have a big bearing on your insurance premium. If your radius is greater than the radius that you intend to travel, you should consider reducing this as it can lower your insurance premiums.

Reviewing your drivers

Specifically noting that you have under 25-year-olds driving your vehicles attracts a larger premium. If you have had staff members that were under 25 driving your vehicle but are no longer doing so, you should update your insurance policy to remove them as this will lower your insurance premium.

Reviewing your accessories that are listed

It's extremely important to note all of your vehicle accessories under your policy to ensure that if your vehicle was written off, you would be financially reimbursed adequately. Adding accessories to your policy is likely to increase your insurance premium. A solution on how to keep your insurance premiums low is by reviewing your commercial motor insurance policy coverage. Most commercial motor insurance policies offer automatic additional accessories to your policy up to a certain value ($5,000 is standard). If your insurer offers this cover, you won't need to list accessories that are automatically covered.

Paying your insurance premium annually, and not monthly

An easy way to lower your insurance premiums is not to opt for monthly instalments. Monthly Instalments tend to add around 10% extra to your motor vehicle insurance. However, the convenience of monthly instalments may be worth the additional cost to alleviate your cash flow.

Shopping around

One of the easiest ways to reduce your Commercial Motor vehicle Insurance is to engage Morgan Insurance Brokers. Morgan Insurance Broker has access to a large panel of approved insurers for your Motor Vehicle Insurance. We can approach close to 10 providers on your behalf to ensure that the premium you are receiving is the most competitive for your circumstances. View our fleet insurance brokers page for more information.

We do the hard work for you. We also understand that there is no need to be paying overs for insurance when it's simply not required.

NSW Introduces Mandatory requirements for all registered Design Practitioners, Principal Design Practitioners, and Professional Engineers

All registered Design Practitioners, Principal Design Practitioners, and Professional Engineers must have in place a Professional Indemnity Insurance Policy as of July 1st 2022 under NSW new fair trading mandatory requirements. (fairtrading.nsw.gov.au)

What is Professional Indemnity Insurance?

Professional indemnity insurance is an insurance policy that protects your business from claims brought against you for advice, recommendations, breach of professional duty, and alleged negligence that results in a financial loss to third parties.

Do I need Professional Indemnity Insurance?

As of July 1st in NSW, Professional Indemnity Insurance is mandatory for all registered Design Practitioners, Principal Design Practitioners, and Professional Engineers.

What information do I need to provide to obtain a Professional Indemnity policy?

In order to obtain a Professional Indemnity policy, a proposal form will be required to be completed. A proposal form is a document that the insurers request you complete in order to better understand your business and the activities you are looking to insure. They do not take long to complete.

How long does it take to obtain a Professional Indemnity policy?

As your Insurance Broker, we send your request out to a large panel of insurers on your behalf. Depending on if different insurers require additional information from you, you could expect a quote returned from the insurers within a few days.

How much does Professional Indemnity insurance cost?

As Professional Indemnity Insurance is an insurance policy that insures for your mistakes, we know that the mistakes in your industry could be catastrophic. The premiums are quite considerable. The main considerations for the insurers calculating your premiums are your business activities, your annual turnover, and how many employees you have.

How do I obtain Professional Indemnity Insurance?

Morgan Insurance Brokers takes the hard work out of the equation. We approach a large panel of approved insurers on your behalf and negotiate coverage and pricing for your business. We then provide you with the quote that we recommend that we believe will provide your business with the most protection. We are your main contact for all Insurance related queries, meaning you will never have to speak to any insurance company directly.

Lauren was amazing to work with so much on going help was awesome. Highly recommend using the services on offer. 10 stars **********

Peter Stapleton

Lauren Spice did a great job at finding multiple insurance products at short notice – she worked on it instantly and got the job done efficiently and professionally provide options not just one quote.

Jesse Murphy

Lauren did an excellent job in accessing appropriate insurance for my medical services company. Responded to my first email in the middle of the night. Rare to get such efficient service these days

Jonathan Ramsay

Lauren was awesome helping us to sort out our insurance incredibly quickly. Called her urgently in the morning as we needed the insurance by 5pm on the same day and she had organised a series of quotes and recommendations within a couple of hours. Would highly recommend her!

Rommo Pandit

I dealt with Lauren and she was fantastic. She’s very knowledgable and had all the answers. Would recommend reaching out to her if you need anything insurance related.

Steven Pretty

I have dealt with Lauren from MIB insurance for the last 3 years. Lauren’s attention to detail is incredible and she goes above and beyond in finding the best insurance cover for our business. I can not recommend Lauren highly enough. She has recently insured our second business as well. I recommend MIB to all of my business colleagues.

David Glenister

Lauren has been so helpful, accessible and efficient, helping us to insure our first home!

Maddie Humphrey

The very best insurance services!

Pete Smith

Contact Us

"*" indicates required fields