Lauren Spice

Director & Senior Insurance Broker

Lauren Spice

Director & Senior Insurance Broker

Meet Lauren

Hi, I’m Lauren.

Director of Morgan Insurance Brokers, insurance enthusiast (yes, we exist).

My day consists of broking, problem solving, hours of phone calls (because email just doesn’t cut it), and making sure my clients don’t lose sleep over things that insurance should be taking care of.

I spend a lot of time talking to clients to make sure that I get it right the first time. The more I know about someone’s business or life, the better I can protect it. I remember the little details, check in unprompted, and send you reminders before you even realise something needs attention.

I also lead our amazing team, which is something I’m really proud of as they drive exceptional results and are incredible people. I’m hands on, always available, and I love seeing people grow into their strengths. Whether I’m helping with a tricky claim, placement queries (self proclaimed placement Queen), brainstorming solutions, or just keeping things moving, I’m very much “in it” with my colleagues, we work together, and we support each other.

Behind the scenes, I’m constantly tweaking things to make the business run smarter, smoother, and more client friendly.

As Director, I ensure Morgan Insurance Brokers maintains its reputation for excellent service, strong relationships, and expert insurance advice. My focus is always on protecting clients’ interests while guiding the business towards the moon.

Insurance Experience and Expertise

Starting Morgan Insurance Brokers from the ground up meant that I had to take every opportunity that came my way, even if I hadn’t worked with that particular industry before. Fast forward to now, I have experience in almost every industry and am confident in all types of insurance. Whilst construction really is my favourite, I can a manage all types of insurance and occupations with confidence.

Business Insurance

I’ve spent years helping small-to-medium businesses all over Australia put together insurance programs that actually make sense for them. I love working directly with business owners to understand what they do, where their risks are, and what they need to protect.

No two businesses are the same, so I always create customised cover that fits properly, whether you’re running a retail store, a professional services firm, a manufacturing business, or you’re out on the tools in a trade. My focus is always on keeping things clear and simple, avoiding unnecessary costs, and making sure you’re properly protected without paying for things you don’t need.

Public Liability Insurance

Public Liability is such a core part of protecting any business, and it’s something I’ve really specialised in over the years. I like helping clients actually understand what this cover does and how it applies to the way they work. I work with businesses of all shapes and sizes, talking them through the specific risks they face when dealing with clients, contractors, or the general public.

I make sure my clients have the right cover for things like third-party injury, property damage, product liability, and any contractual requirements they need to meet. I also spend a lot of time helping those in higher-risk industries like construction, hospitality, and retail, where getting the details right really matters.

Professional Indemnity Insurance

I have a really strong background in working with professional services businesses, so I spend a lot of time helping to get the right Professional Indemnity cover in place. I know how stressful the idea of a negligence or error claim can be (because in insurance, if I made a mistake with my clients, it could be catastrophic too) so my focus is always on making sure you’re properly protected if something unexpected pops up.

My goal is to give professionals the confidence to trade, advise, and operate knowing they’ve got solid protection behind them because even the most careful experts can face claims they never saw coming.

Construction & Trades Insurance

I’ve worked with builders, subcontractors, and tradies for my entire working career, so I really understand the unique risks that come with the construction world. I help clients sort out everything from Contract Works and Public Liability to Plant & Equipment, Tools cover, and all the other specialised policies you need on site.

I love construction mostly because the business owners you are dealing with are always so genuine and down to earth.

Commercial Property Insurance

Commercial property owners come to me to help protect their buildings, contents, machinery, and rental income from all the unexpected things that can go wrong. I work with investors, landlords, and business owners to make sure they’ve got the right cover for fire, storm, theft, accidental damage, tenant risks, and business interruption, all the big ones that can really impact income if something happens.

Life, TPD, Income Protection & Trauma Cover

Alongside general insurance, I also help individuals, families, and business owners with their personal risk insurance. I guide clients through things like Life insurance, TPD, Income Protection, and Trauma Insurance, and explain how each one plays a different role in keeping you financially secure if something unexpected happens, whether that’s illness, injury, or loss.

I take a really holistic approach, because I want people to feel confident that not only are they protected, but their loved ones are too. Life can throw curveballs, and my job is to make sure you’ve got the right safety nets in place so you can focus on living, knowing the important things are taken care of.

Strata Insurance

I also help strata owners and committees navigate the (often very confusing!) world of strata insurance. Whether it’s a small block of units, a townhouse complex, a large high rise, or a mixed-use building, I make sure the property is properly protected with the right strata insurance.

My goal is to make things simple for committees and owners, clear explanations, tailored advice, and the peace of mind that the building and its residents are looked after. And if there’s ever a claim, I’m right there helping coordinate everything so the process is smooth, fair, and as stress free as possible.

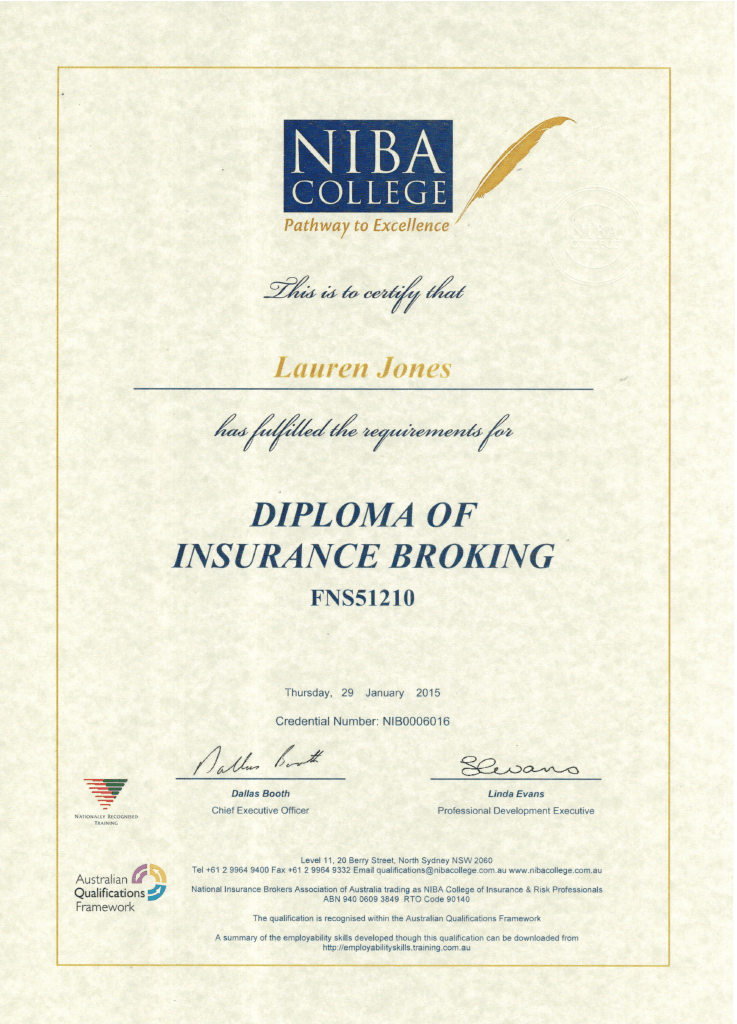

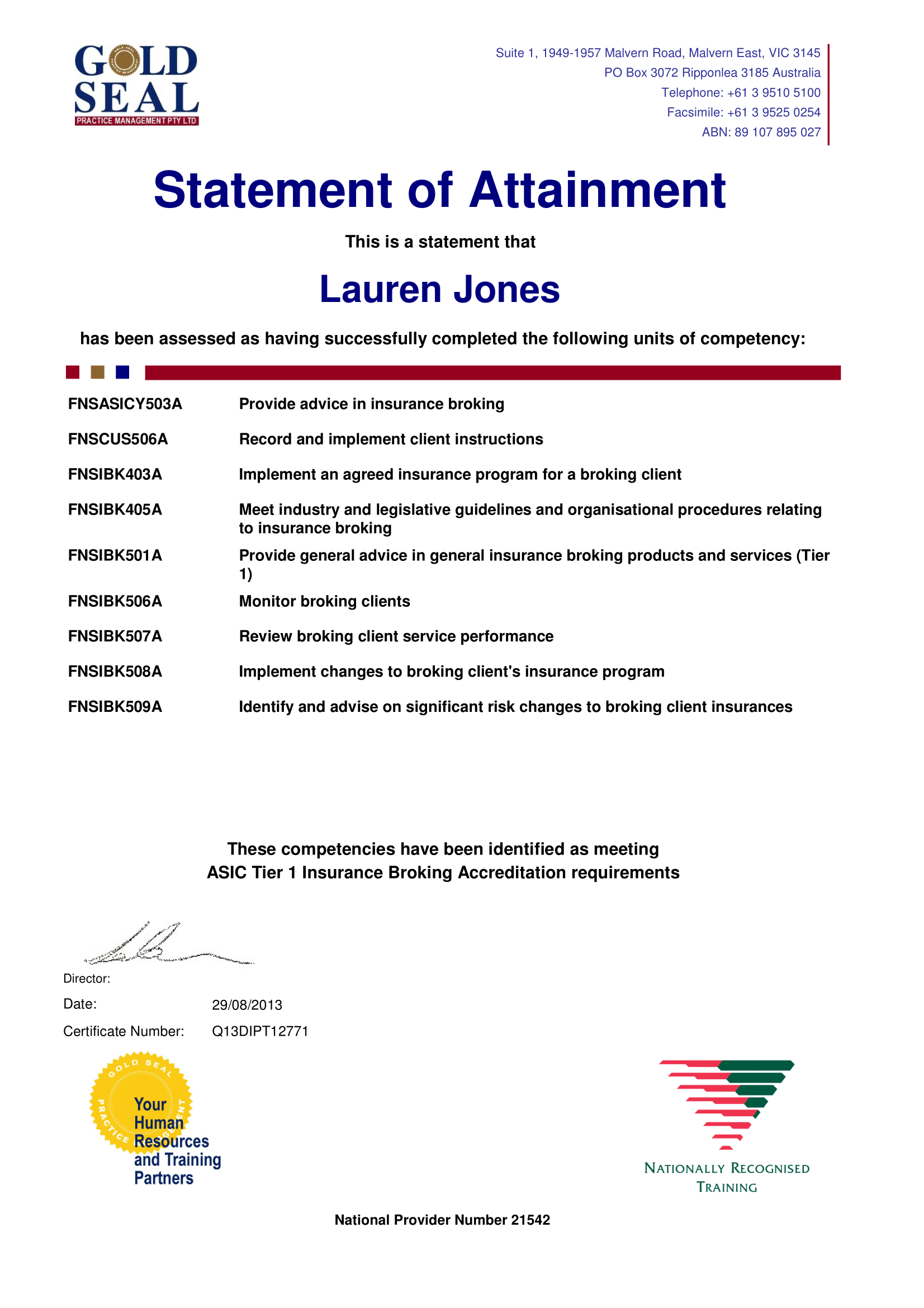

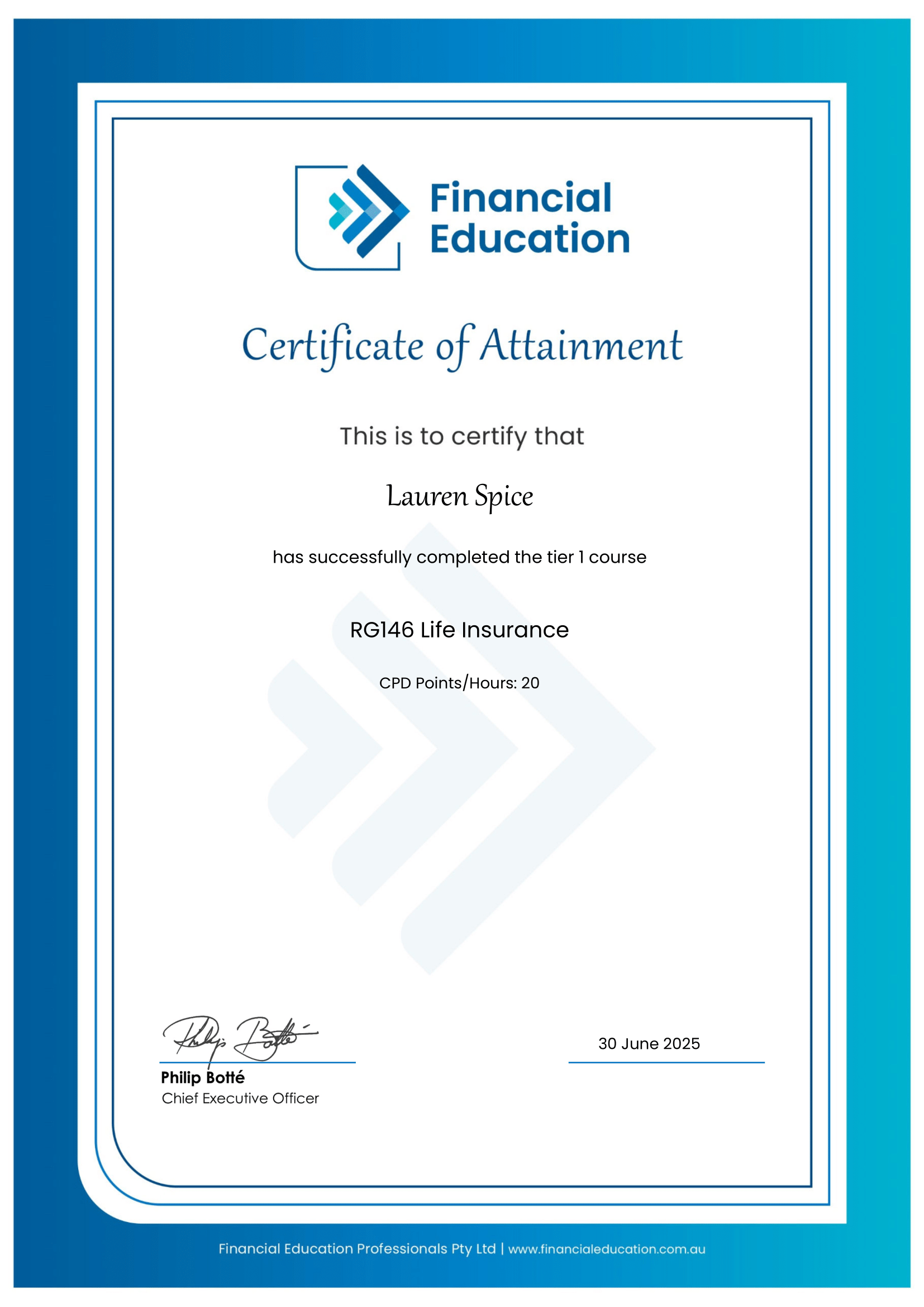

Qualifications & Certifications

Diploma of Insurance Broking

Tier 1 Insurance Broking

Tier 2 General Insurance

Tier 1 Life Insurance

Approach To Insurance

I’m a big believer that insurance should feel personal, not something that you bought online in 20 seconds. Every business and every person has their own story, their own goals, and their own worries and I love taking the time to really understand all of that before suggesting any kind of cover. Getting to know my clients properly is honestly one of my favourite parts of the job.

I focus on creating tailored solutions because I want my clients to feel genuinely protected, not just handed a generic policy. My goal is always to match real world risks with the right cover, so everything feels practical, thoughtful, and perfectly suited to them.

I don’t just place policies, I help people understand why the cover matters and how it keeps their business (and their peace of mind!) running smoothly.

Long-term relationships mean everything to me. I love being the person clients know they can rely on, someone who’s consistent, caring, and always ready to help. When a claim comes up, I’m right there in the thick of it, advocating, coordinating, and making sure everything is handled fairly. To me, insurance isn’t just about paperwork and policies, it’s about standing beside my clients when they need it most.

Work History

Early Career

My insurance career began at Australian Insurance Solutions in 2012 to 2015 as a Junior Broker, managing a domestic client book before moving into broader commercial roles.

From 2015 to 2016, at Insure 247 Australia, I gained extensive experience in claims handling, renewal management, broking risk identification, client service, and policy review. I developed strong relationships with both clients and underwriting partners, and handled new business, renewals, and corporate broking functions start to finish.

Current Endeavours

Morgan Life

In July 2024, I co-founded Morgan Life with my Co-Director, Katarzyna Urbaniak. We created Morgan Life with one clear purpose: to make insurance more affordable, faster, and easier for everyday clients. We saw how complicated and time-consuming the insurance process could be, and we wanted to build a service that cuts through the confusion and delivers real value quickly.

Morgan Insurance Brokers

Morgan Insurance Brokers started in 2018 whilst I was working with a previous brokerage. I built my client base up over a few years by networking after work every week, and working on MIB after hours and on weekends. In 2022 I was able to leave that role and throw everything into Morgan Insurance Brokers. Since then, it has exploded from nothing short of just plain and simple hard work , and consistency.

I am very hands on with my clients, and still pick up the office phone call when it rings, and still work on weekends (albeit very rarely though now yay!) to make sure things are running smoothly.

Personal Life

Outside of work, my world is pretty simple and I absolutely love it that way. I’m proudly smartphone free (yes, really!) and a big advocate of this for mental health, which means when I’m not in the office, I’m fully present in my own little universe with my husband and our two boys. They keep me grounded, entertained, and constantly reminded of what actually matters.

We’re a family that loves getting out and exploring Australia whenever we can so if you ever get a call from me, I could be in the middle of nowhere when I call. My home life is stable, calm, and exactly the balance I need from my busy work world. I spend most of my downtime just enjoying being with my family, keeping life simple, and trying to show up every day as the best version of myself. No chaos, no clutter, just love, laughter, and road trips with the people who mean the most to me.

Future for Lauren and Morgan Insurance Brokers

Looking ahead, I see myself in the insurance broking industry for the long haul. This isn’t just a job for me, it’s a career I genuinely love and one I plan to keep growing in for the rest of my working life. My goal is to continue developing my expertise, evolving with the industry, and staying at the forefront of what great broking looks like.

I also have a really personal vision for Morgan Insurance Brokers. I don’t just want us to grow, I want us to grow in a way that reflects the values I care about trust, real connection, and genuinely looking after people. My dream is to see our brokerage become one of Australia’s most recognised and respected names, not because we’re the biggest, but because we’re known for doing things the right way.

I’m excited about where we’re heading. I’m proud of what we’ve already built, and I’m motivated by what’s still ahead. As the industry evolves, so will I, and so will Morgan Insurance Brokers. This isn’t just a career path for me, it’s something I’m deeply committed to, and I can’t wait to see how far we can go.

Get In Touch With Lauren

Phone: (07) 3778 5845

Email: lauren@morganinsurancebrokers.com.au

Broker Licensing

- Morgan Insurance Brokers Pty Ltd is a Corporate Authorised rep (ASIC no 001292274) of Brindabella Insurance Brokers Pty Ltd AFSL 000500149.

- Morgan Insurance Advisors Pty Ltd is is an Authorised Rep of HAE Financial Pty Ltd AFSL 50189.

Lauren Spice Individual AR Number 001310613

Featured Blogs by Lauren

Income Protection Insurance for Electricians in Australia

15 February 2026

How Much Does Landlord Insurance Cost in Australia?

13 February 2026

Should I Use a Broker or a Financial Planner for Insurance?

13 February 2026