Is It Worth Having Income Protection Insurance?

Income protection insurance offers a tax-free monthly income replacement if you are unable to work due to injury or medical reasons. This coverage includes benefits for both mental health issues, like stress-related conditions, as well as physical ailments such as back pain, cancer, or stroke.

You may be thinking “is income protection insurance really worth it?” Well, with income protection insurance, you gain peace of mind knowing that you have a financial safety net to cover your bills during periods of illness or injury. Depending on the policy, coverage continues until you either return to work or reach retirement age.

Here’s how it works –

Coverage – The insurance typically covers up to 70% of your pre-tax income. However, some insurers may have a monthly cap on the maximum amount they pay out.

Waiting Period – There’s a waiting period between when you become unable to work and when the payments begin. Longer waiting periods often result in lower premiums.

Benefit Period – The benefit period is the length of time the insurance company will provide payments, usually ranging from two to five years or until you reach a certain age, like 65.

Premiums – The cost of premiums depends on factors such as your age, occupation, health, lifestyle, the coverage amount you choose, the waiting period, and the benefit period.

Exclusions – The insurance doesn’t typically cover situations like deliberate self-harm, suicide attempts, normal pregnancy and childbirth, war, or criminal activities.

Get a QuoteWhen is it Worth it?

Here are some scenarios where income protection insurance is worth considering –

When you have limited savings and/or dependents

If you have limited savings and people who rely on your income, income protection insurance can help maintain financial stability and cover essential expenses like rent or mortgage payments, groceries, utility bills, etc.

When you are self-employed or a casual worker

If you are self-employed or a casual worker without access to sick leave or paid time off, income protection insurance becomes even more critical. It replaces the income you would lose due to an illness or injury, ensuring you can still manage your financial obligations.

According to the Australian Bureau of Statistics (ABS) as of August 2023, there are 1 million independent contractors in Australia who may not have access to sick leave. Additionally, 2.7 million employees (22% of all employees) are not entitled to paid leave. These figures highlight significant aspects of the Australian workforce and their working conditions and how income protection insurance can play a vital role in protecting the workers of Australia.

Get a QuoteWhen you have debts and financial obligations

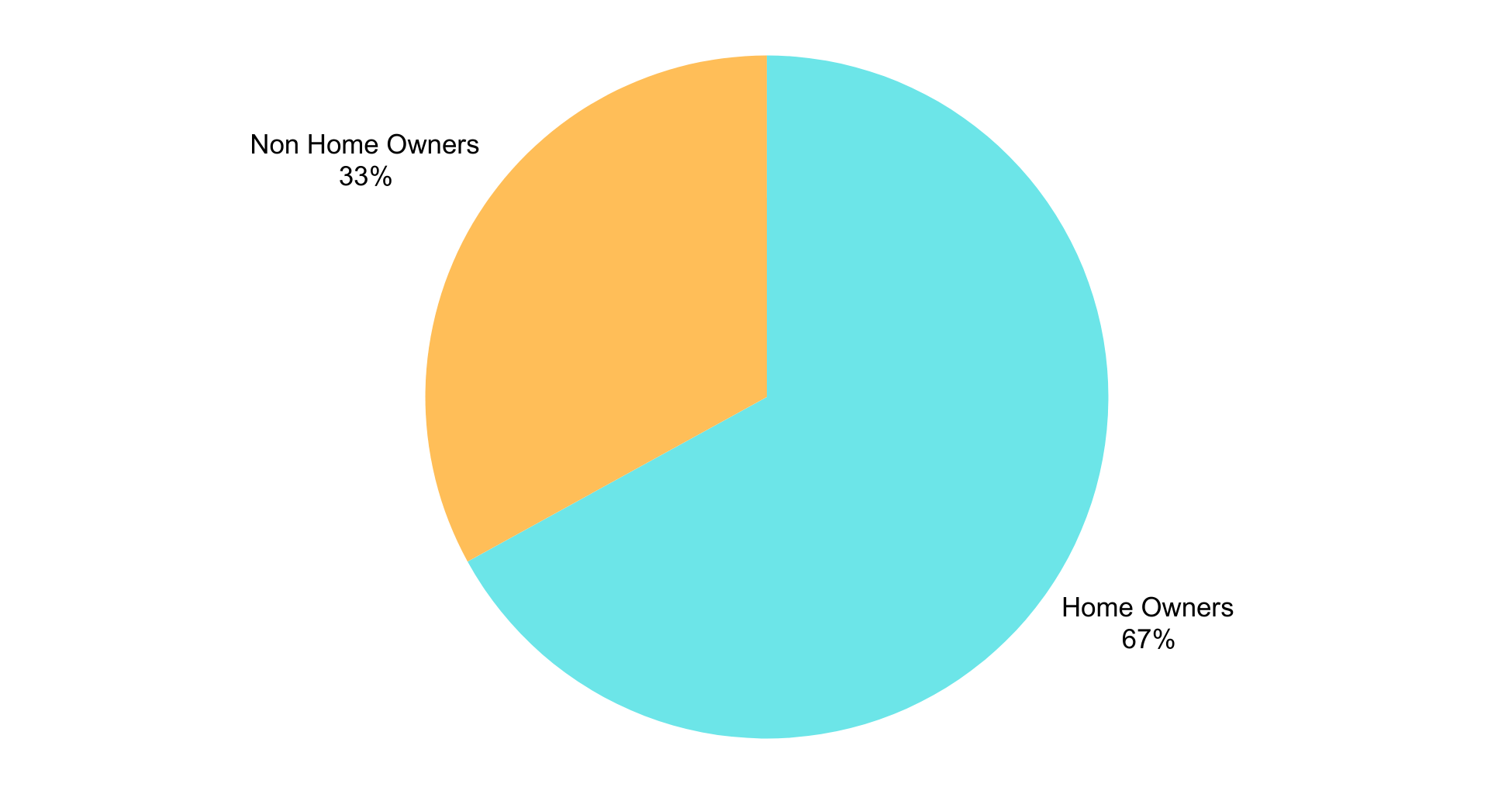

If you have major financial obligations such as a mortgage or rent, car loans, or credit card debt, income protection insurance can help you stay on top of your repayments. It provides a financial buffer, reducing the risk of defaulting on your loans and potentially facing financial difficulties. According to the Australian Bureau of Statistics (ABS), 66% of Australian households own their home, either outright or with a mortgage. This high rate of homeownership shows the importance of income protection insurance. For homeowners, maintaining mortgage payments is crucial to avoid financial distress or even foreclosure in the event of an unexpected illness or injury.

When you work in a high-risk occupation

If your job involves physical labour, operating machinery, or other high-risk activities, the chances of work related injuries are higher. Income protection insurance can be beneficial in such occupations, offering financial support during recovery.

When is it No Longer Worth it?

While income protection insurance offers valuable financial security, there are certain situations that make it less of a priority.

Sufficient savings and low expenses

If you have a sufficient emergency fund or minimal expenses, and can manage financially for an extended period without your regular income, income protection might be less crucial. This is particularly relevant if you have low or no debts and have no dependents.

Nearing retirement with ample savings

If you’re nearing retirement and have substantial savings, income protection will seem less appealing. Instead of paying premiums, you might choose to retire early if faced with a sudden health event, choosing to utilise savings for financial support.

Low-income earners

If you’re a low income earner, you might not find income protection insurance appealing compared to other types of insurance like Total & Permanent Disability insurance insurance which offers a payout if you are permanently unable to work, regardless of your earnings. This is because income protection insurance often replaces a portion of your income which might not be substantial for low-income earners.

Why Choose Morgan Insurance Brokers?

At Morgan Insurance Brokers, our team brings extensive experience, knowledge, and expertise in the insurance industry.

We recognise that obtaining the right income protection insurance can be challenging, particularly when looking for thorough coverage from a reliable provider. That’s why we’re committed to identifying the best coverage and pricing that fits your individual requirements. With connections to major insurers, our experts are here to help you navigate your choices and make an informed decision.

Our aim is to assist you in managing your rent or mortgage, handling everyday expenses, and ensuring you don’t have to depend on friends, family, or other sources for financial aid.

Get a QuoteAuthor

-

Diploma of Insurance Broking | Tier 1 & 2 Insurance Adviser | Tier 1 Life Insurance Specialist | QPIB | NIBA Member | Steadfast Network Broker

Lauren is a Qualified Practising Insurance Broker (QPIB), a member of the National Insurance Brokers Association (NIBA), and part of the Steadfast broker network.

Lauren has over 15 years of experience in the Australian insurance industry and specialises in income protection, business insurance and risk advisory for Australian businesses and individuals. She holds a Diploma of Insurance Broking and is qualified across Tier 1 and Tier 2 general insurance and Tier 1 life insurance.

Professional & Licensing Information

Morgan Insurance Brokers Pty Ltd is a Corporate Authorised rep (ASIC no 001292274) of Brindabella Insurance Brokers Pty Ltd AFSL 000500149.

Morgan Insurance Advisors Pty Ltd T/A Morgan Life is an Authorised Rep (ASIC no 319449) of HAE Financial Pty Ltd AFSL 501891.

Lauren Spice Individual AR Number 001310613