How Much Does Insurance Cost for a Sole Trader?

As a sole trader, your business and personal assets are mixed together. This makes conducting business both easy and difficult. When accidents happen, it is not just your business that takes a hit, you do as well. When building a business as a sole trader, insurance is key to ensuring long-term financial security, but the cost can vary depending on different factors.

These are things specific to your business, like the type of insurance needed, level of business risk, and any previous insurance claims.

We know that starting a business is tough, especially during a cost of living crisis, but that’s why we are here to help you choose the right insurance policies for you. Morgan Insurance Brokers are dedicated to building the perfect insurance policies for your business while keeping costs low.

Insurance for Sole Traders

Deciding what insurance you need as a sole trader can be a difficult task. It largely depends on what industry you are going into, though there are standard insurance policies that are recommended no matter the industry. These are:

- Public liability insurance

- Professional indemnity insurance

- Income protection insurance

- Business insurance

- Personal accident and illness insurance

Other industry-specific insurance policies to consider should be:

- Truck insurance

- Tool insurance

- Boat insurance

- Strata insurance

- Cyber insurance

No matter what you go with, insurance is important for sole traders. It protects them from unexpected risks and liabilities while providing financial security and peace of mind.

Factors Affecting Insurance Costs

Asking how much your insurance will cost is like asking a fortune teller to predict the weather; it’s an incredibly complex question with no right answer. Without discussing the ins and outs of your business and providing you a quote, most insurance brokers will be hard pressed to give you any kind of straight answer. However, there are several factors that insurance companies take into account which can affect the cost of your insurance:

Industry and occupation

Generally speaking, industries like construction, healthcare, and IT tend towards having higher premiums. This is because they are considered high-risk, either because of the increased risk of injury or illness or the risk in data security.

Business size and revenue

You may be asked to declare your annual revenue when getting insurance for your business. The bigger your business, the higher your premiums may be. This could be because of a higher chance of liability claims from clients.

Location

Quite often, insurers will take into account location-based risks when looking into your insurance premiums. Things like crime rates, high risk of natural disasters such as bushfires or floods, the amount of claims made from other business properties in that area, and also if you have dealings in multiple states all affect your premiums.

Level of Coverage

If you want more insurance coverage for your business, this can also have an impact on the costs. Generally, having higher limits on liability equates to higher premiums. For example, someone who has a $30,000 liability limit on their insurance will pay a much lower amount than someone who has a $50,000 liability limit, not counting any other outside factors.

Claims history

Your premiums can increase if you had an insurance policy that you previously made a claim from. Claims affect future premiums regardless of the insurance company you were with previously. It is a legal obligation to disclose any previous incidents that influence the insurers decision to accept their risk.

Choice of insurance provider

All insurers have different price ranges, that is a simple fact, so whichever insurance package you choose will be priced differently for all businesses based on the information above. This is why it is essential to get quotes from multiple providers to make sure you are getting the best insurance package possible for your business.

Insure with Morgan Insurance Brokers

Working with an insurance broker means that you are getting specialist advice that goes far beyond what an insurance company would offer. They compare different insurance companies to tailor-make policies and so are getting the best and most cost-effective coverage possible for your business.

When you work with us at Morgan Insurance Brokers, we do all of the above and more. With more than 150 insurers working with us, we can craft the perfect insurance coverage at the lowest cost to your business.

Don’t let risk run your business, contact us for a free quote today and protect your future.

What is the average cost of income protection insurance in Australia?

What is the average cost of income protection insurance in Australia?

Did you know that nearly 1 in 5 Australians will experience a period of disability or illness that prevents them from working? Without income protection insurance, many would face financial hardship, relying on savings or government support, which often falls short. Income protection insurance can provide a crucial safety net, replacing a portion of your income and ensuring that you can focus on recovery, not finances.

In this article, we will explore the importance of understanding the cost of income protection insurance in Australia. We’ll cover key factors that influence premiums, such as age, occupation, and health status, and how to assess the right level of coverage for your needs. Additionally, we’ll look at the different types of policies available, common pricing structures, and tips for managing premiums while ensuring you’re adequately protected. By the end, you’ll have a clearer understanding of how to make an informed decision about income protection insurance that aligns with your financial goals and lifestyle.

Understanding income protection insurance

What is income protection insurance and what does it cover?

Income protection insurance is a type of policy designed to replace a portion of your income if you become unable to work due to illness, injury, or disability. It typically covers up to 70% of your pre-tax income plus super guarantee and can provide financial support for a set period, often until you’re able to return to work or reach retirement age, depending on the policy terms. The coverage can help with everyday living expenses, such as mortgage payments, bills, and groceries, ensuring that you can maintain your lifestyle during periods when you’re unable to earn an income. Income protection can also cover temporary or long-term disabilities, offering peace of mind during unexpected health challenges.

Understanding the cost of income protection insurance

Understanding the cost of income protection insurance is crucial for individuals in Australia because it helps ensure they are adequately covered without overcommitting financially. While this type of insurance can offer invaluable support during times of illness or injury, it’s important to balance the cost of premiums with the benefits. A well-calculated premium can provide financial peace of mind without straining your budget. Knowing the factors that influence pricing—such as age, occupation, health status, and policy features—can help you choose an insurance policy that meets your specific needs and circumstances. In Australia where unexpected events can disrupt your ability to work, being informed about the costs of income protection insurance can be a key step in securing your financial future.

The importance of income protection insurance

Income protection insurance is particularly important for individuals with dependents or significant financial obligations because it provides a safety net during times when you’re unable to work. For those with family responsibilities, such as children or a partner who relies on your income, losing your ability to earn can cause severe financial strain. This insurance ensures that essential expenses, like mortgage payments, school fees, and daily living costs, are covered, so you can focus on recovery without the added stress of financial instability. It helps safeguard your family’s financial well-being and maintains your lifestyle even during unexpected setbacks.

How Income Protection Insurance Policies work

Indemnity Policies:

How it works: Since October 2021 any new policy offered will be an indemnity contract. Following a claim the insurer pays a benefit based on your income at the time of the claim, which may be lower than what you were earning when you took out the policy. The policy will cover no more than 70% of income generated just prior to disability.

Factors Influencing the Cost of Income Protection Insurance

Several factors can influence the cost of income protection insurance premiums in Australia. Understanding these can help you tailor your policy to your needs while managing costs effectively.

Age

Premiums typically increase with age, as older individuals are more likely to experience health issues that could impact their ability to work. The younger you are when you take out a policy, the lower your premiums are likely to be.

Gender

On average, women tend to pay higher premiums than men. This is primarily because women are statistically more likely to make claims due to pregnancy-related conditions and are also often at higher risk of long-term illnesses such as autoimmune diseases. However, the gender gap is narrowing as more insurers move toward gender-neutral pricing.

Occupation

Risk of Occupation

Your job type plays a significant role in determining your premiums. Occupations with higher risk factors (e.g., construction workers, miners, or emergency services personnel) usually attract higher premiums because of the greater likelihood of injury or illness that could prevent you from working.

Risk Classification

Insurers classify occupations into different risk categories, ranging from low-risk office jobs (e.g., desk-based roles) to high-risk occupations (e.g., manual labor or hazardous work environments). The higher the risk associated with your job, the more you can expect to pay for coverage.

Health

Your current health status is one of the most important factors in determining premium costs. Insurers may require you to complete a medical assessment or disclose any pre-existing conditions, such as chronic illnesses or past surgeries. Individuals with ongoing health issues may face higher premiums or exclusions in their policies.

Lifestyle

Lifestyle choices, such as smoking, drinking, or engaging in risky activities like extreme sports, can also affect your premiums. Smokers, for example, usually pay significantly higher premiums than non-smokers because of the increased health risks. Maintaining a healthy weight, regular exercise, and avoiding high-risk behaviors can help keep your premiums lower.

Benefit Period

The longer the benefit period, the higher the premiums. If you choose a longer period to receive payouts (e.g., until retirement age), your premiums will be higher due to the insurer’s increased financial exposure.

Waiting Period

The waiting period refers to the amount of time you must wait after becoming unable to work before your benefits start. A shorter waiting period means higher premiums because the insurer will begin paying out sooner. Opting for a longer waiting period (such as 60 or 90 days) can reduce your premiums, but it also means you’ll need to have savings or other financial resources to cover your expenses in the meantime.

Level of Coverage

The amount of coverage you choose—whether it’s a percentage of your income (typically 70%) and/or additional benefits—will also influence costs. Higher levels of coverage or additional features (like rehabilitation support or partial disability benefits) will result in higher premiums. Conversely, selecting lower coverage or fewer add-ons can reduce your premium.

By understanding how these factors influence the cost of income protection insurance, you can make informed decisions about your coverage. Tailoring your policy to your personal circumstances—such as choosing a reasonable benefit period or making lifestyle adjustments—can help you balance premium affordability with comprehensive protection.

Average Costs of Income Protection Insurance in Australia

The cost of income protection insurance can vary widely based on multiple factors, including your age, occupation, health, and the level of coverage you select. Below is an overview of typical costs and a breakdown of how different factors influence premiums.

General Range

On average, income protection insurance premiums in Australia range from **$30 to $100 per month** for basic coverage with a stepped premium. However, premiums can rise depending on the level of coverage, age, health, and occupation.

Age-Based Analysis

Under 30 years old

Premiums for young, healthy individuals tend to be on the lower end of the scale. You might expect to pay between **$30 and $50 per month** for basic coverage under stepped premium.

30 to 39 years old

As you age, premiums will naturally rise. For this age group, premiums typically range from **$50 to $80 per month** depending on the level of coverage and other factors under stepped premium.

40 to 49 years old

At this stage, premiums rise due to an increased likelihood of health issues and potential claims. Expect to pay between **$70 and $120 per month** for basic coverage, though this can go higher depending on your specific circumstances under stepped premium.

50+ years old

Premiums significantly increase for individuals over 50 due to the higher risk of injury or illness. For someone in this age group, premiums can range from **$120 to $200 or more per month**. Entry age restriction if over 60.

Occupation-Based Analysis

Low-Risk Occupations (e.g., office workers, teachers, IT professionals that are not purely office based):

Individuals in lower-risk jobs can expect lower premiums, typically around **$40 to $70 per month** for basic coverage under stepped premium. However, this can increase depending on other factors such as health, age, and policy features.

Moderate-Risk Occupations (e.g., retail workers, salespeople, administrators):

People in moderate-risk jobs may pay premiums between **$60 to $120 per month**. These professions may involve some physical activity or higher stress, which slightly increases the risk of illness or injury.

High-Risk Occupations (e.g., construction workers, miners, first responders, pilots):

High-risk jobs attract higher premiums due to the increased likelihood of injury. Individuals in these roles can expect premiums ranging from **$100 to $250 or more per month**, depending on factors such as age and level of coverage under stepped premium. The riskier the occupation, the higher the premium, especially if the policy includes features like a shorter waiting period or higher benefit amounts.

Comparing Costs Across Providers

When shopping for income protection insurance in Australia, it’s important to compare not just the costs, but also the quality of coverage and the value offered by different providers. The total disability requirement during the waiting period a is a major component in determining the optimal policy.

Cost Comparison

While costs vary based on individual circumstances (such as age, occupation, and coverage), here’s a general comparison of premiums from major insurers for a 35-year-old office worker, with a 30-day waiting period and a 2-year benefit period:

– **AIA Australia**: Approx. **$70 (stepped) to $120 (level) per month**

– **MLC Life Insurance**: Approx. **$75 (stepped) to $130 (level) per month**

– **TAL**: Approx. **$80 (stepped) to $125 (level) per month**

– **Zurich Australia**: Approx. **$75 (stepped) to $120 (level) per month**

These costs are based on general pricing for standard policies. As you move into higher-risk occupations or older age brackets, the premiums can increase significantly across all providers.

Value for Money

While the cost of premiums is an important factor in choosing an income protection insurance policy, value for money involves a broader evaluation. Here are some key aspects to consider when assessing value:

Claims Process

A smooth, quick claims process is crucial. Even if a policy is affordable, poor claims service can result in unnecessary stress when you need it most.

Policy Flexibility

A good income protection policy should be flexible enough to meet your changing circumstances. In most cases an increase to cover or a reduction in the benefit period will require additional underwriting and a personal statement to be completed by the life insured.

Customer Service

Strong customer service can make a big difference in your overall experience. Some insurers offer online tools and dedicated agents to help with policy management, while others may have more limited support.

Additional Benefits

Some providers offer additional services or perks that can enhance the value of their policies. These extras can significantly improve the overall value, even if the premium is slightly higher.

Policy Features

Some insurers offer flexible benefit periods and optional riders like partial disability cover or ongoing rehabilitation support. Features like these can provide long-term financial stability, even if the initial premium is higher.

By carefully comparing costs and assessing the overall value of the policies, you can choose an income protection insurance provider that meets your needs while ensuring peace of mind and financial security in case of illness or injury.

Ways to Lower the Cost of Income Protection Insurance

While income protection insurance is a crucial safety net, it can sometimes feel expensive. However, there are several strategies you can use to reduce the cost of premiums while still ensuring adequate coverage. Here are some key ways to lower your premiums:

Healthy Lifestyle

Insurance providers typically assess the risk of insuring you based on factors such as your health, lifestyle, and medical history. Maintaining a healthy lifestyle can significantly reduce your premiums. For example, if you’re a non-smoker, engage in regular exercise, and have a healthy weight, insurers view you as a lower risk for illness or injury, which can lead to more affordable premiums.

Practical Tips:

- Quit smoking if you’re a smoker. Smokers pay higher premiums than non-smokers

- Stay active, eat a balanced diet, and manage stress to reduce the risk of chronic conditions like diabetes, hypertension, or heart disease.

- Regular health check-ups can also help identify and address potential health issues early, improving your health status and lowering your premiums.

Policy Adjustments

Longer Waiting Period

One of the most effective ways to reduce your premium is by choosing a longer waiting period before benefits kick in. The longer the waiting period (the time between becoming unable to work and when you start receiving your benefits), the lower your premiums will be. If you have sufficient savings or other resources to tide you over, opting for a 60 or 90 day waiting period instead of 30 days can make a significant difference.

Shorter Benefit Period

If you don’t need long-term coverage, consider selecting a policy with a shorter benefit period (e.g., 2 or 5 years instead of until retirement age). This will lower your premiums, though you’ll need to ensure that the duration still provides adequate support for your financial needs.

Reduce the Coverage Amount

Another way to save is by lowering the percentage of your income covered by the policy. For example, reducing coverage from 70% to 65% may lower premiums, but it also means you’ll have to manage with a smaller payout in case of illness or injury. Make sure the amount you choose still aligns with your financial obligations.

Shopping Around

Compare Quotes

Insurance premiums can vary significantly between providers, so it’s essential to shop around and compare quotes. Use comparison websites or work with an insurance broker to help you identify the most affordable options for your needs. Factors such as the level of coverage, waiting period, and additional benefits can all affect pricing.

Look for Discounts

Some insurers offer discounts for bundling multiple insurance products (e.g., life insurance, trauma insurance) or for paying premiums annually instead of monthly. Don’t hesitate to ask providers about available discounts or promotional offers.

Review Annually

Your needs and circumstances may change over time, so it’s wise to review your income protection policy every few years. You may find that your premiums increase due to inflation or other factors, and there may be more competitive offers available as your situation evolves.

By implementing these strategies, you can reduce the cost of your income protection insurance while still ensuring that you’re adequately covered in case of illness or injury.

Final Thoughts

Income protection insurance is not just about paying premiums—it’s about ensuring that you’re financially secure if life takes an unexpected turn. While the cost of premiums can vary depending on several factors, it’s important to focus on finding the right balance between affordability and adequate coverage.

If you’re unsure about the best policy for your situation, it’s wise to seek professional advice. Morgan Insurance Advisors can help you navigate the options and find a policy that suits your needs and can allow you to quickly compare premiums and benefits from different providers to ensure you get the best deal. Take action today to safeguard your financial future with the right income protection insurance policy.

Helpful Links

– [MoneySmart – Income Protection Insurance](https://moneysmart.gov.au) – Australian Government website with information on insurance options and consumer rights.

– [Major Insurance Providers: AIA, TAL, MLC Life, Zurich](https://www.aia.com.au), [TAL Insurance](https://www.tal.com.au), [MLC Life Insurance](https://www.mlclife.com.au), [Zurich Insurance](https://www.zurich.com.au)

FAQ's about income protection insurance

The cost is influenced by your age, gender, occupation, health and lifestyle choices, and the terms of your policy (such as waiting period and benefit period).

Yes, by maintaining a healthy lifestyle, choosing longer waiting periods, or reducing coverage levels, you can lower your premiums.

While premiums can be a financial commitment, the protection it provides during illness or injury can be invaluable. It ensures you can continue meeting your financial obligations while recovering. Yes, income protection insurance is worth it.

Here, we do it all. From sourcing the perfect policy, negotiating the terms, and securing it, you can rest assured that we’ll stay on top of it.

- The perfect policy

We help you choose the policy best suited to your needs. We will conduct a thorough assessment of your operations and risks to ensure you have comprehensive coverage that addresses potential liabilities and protects your crane operations effectively.

- No more wait time

With our same-day responses, we guarantee quick turnaround times to address your inquiries and provide prompt assistance.

- Personalized service at every step

Throughout the life of your policy, you will have one dedicated point of contact who will guide you through any updates, claim processes, or adjustments needed.

- Bang for your buck

Save money on your premiums by letting us optimize your insurance investment while ensuring you receive coverage tailored to effectively protect your business.

- Flexibility in payment

We offer monthly installment options, allowing you to spread the cost of your premiums over manageable monthly payments.

To make a claim, contact your insurer, provide necessary documentation (such as medical reports), and follow the insurer’s claim process. Ensure your policy is up-to-date and covers the condition you are claiming for.

What proof do you need for income protection?

Income protection insurance serves as an essential financial safeguard for those who are unable to work due to illness or injury. It guarantees that a portion of your income continues to flow, assisting you in meeting your financial commitments during challenging periods. To access these benefits, you must provide specific documentation to your insurer. This blog will explore what proof you need for income protection.

Proof of Income for Income Protection Insurance

One of the key requirements for income protection insurance is providing proof of your income. This documentation helps the insurer determine the benefit amount you are eligible for. Common documents include:

- Pay Slips: These are the simplest proof for salaried employees, showing regular earnings and deductions.

- Tax Returns: Essential for self-employed individuals, offering a detailed view of annual income.

- Bank Statements: Useful for verifying income, especially from direct deposits.

- Employment Contracts: These documents confirm your salary and employment terms.

Accurate and up-to-date proof of income ensures smooth claim processing and correct benefit calculation.

Medical Evidence for Income Protection Insurance

When claiming income protection insurance, you need to provide proof that you can't work due to a medical condition. Here’s a breakdown of the key documents you might need:

Doctor’s Certificate

A certificate from your doctor is essential. It should clearly state that you are unfit to work and explain your medical condition. This includes:

- Diagnosis: What’s wrong and how it affects your ability to do your job.

- Symptoms: What symptoms you have, how severe they are, and how they impact your daily life and work.

- Duration: How long you’re expected to be unable to work.

- Treatment: Any treatments or interventions you’re undergoing.

This information helps the insurer understand your situation and supports your claim. It is important to visit the doctor as soon as possible after the onset of an injury or illness.

Medical Reports

Detailed reports from specialists or hospitals provide additional evidence. These should include:

- Diagnosis: A thorough explanation of your medical issue.

- Treatment Plan: What treatments, medications, or surgeries you need.

- Prognosis: The expected outcome and recovery timeline.

These reports give the insurer a complete picture of your condition and its impact on your ability to work, ensuring your claim is processed accurately. By providing these documents, you help the insurer understand the severity of your condition and ensure you receive the benefits you’re entitled to.

Employment Information Required for Income Protection Insurance Claims

When you file a claim for income protection insurance, insurers need detailed information about your employment to accurately process your claim. This information helps them understand your job's demands and how your medical condition affects your ability to work. Here’s a closer look at the key employment details you need to provide:

Employment Status

Clearly state whether you are a full-time, part-time, or casual employee. This information helps the insurer understand your work schedule and commitment level.

Job Nature

Provide a brief but detailed description of your role and responsibilities. Highlight the main tasks you perform and any specific skills required for your job.

Work Environment

Describe any specific conditions or environments you work in. This could include exposure to hazardous materials, high-stress situations, or any other unique aspects of your workplace that might affect your health and ability to work.

Performance Impact

Explain how your medical condition has impacted your performance and attendance. Detail any changes in your ability to perform your job duties, any accommodations made by your employer, and how your condition has affected your overall work performance.

This statement from your employer serves as an external validation of your employment details. It helps the insurer assess the impact of your medical condition on your ability to work, ensuring that your claim is processed accurately and efficiently.

By providing a detailed and accurate employer’s statement, you can strengthen your income protection insurance claim and help the insurer understand your situation better.

Personal Identification

To prevent fraud and ensure that the claim is legitimate, insurers require proof of identity. This can include:

- Passport: A valid passport is a widely accepted form of identification.

- Driver’s License: This can also serve as proof of identity.

- Birth Certificate: In some cases, a birth certificate may be required.

Providing accurate identification helps verify your identity and ensures that the claim is processed in your name.

Additional Documentation

Depending on your specific situation, you might need to provide additional documents. These can include:

- Proof of Address: Utility bills or rental agreements can serve as proof of your current address.

- Financial Statements: If your claim involves financial hardship, providing statements that show your financial situation can be helpful.

- Legal Documents: In cases where legal issues are involved, such as a disability resulting from an accident, legal documents might be required.

These additional documents help provide a complete picture of your situation and support your claim.

Why These Proofs Are Necessary

Providing these proofs is essential for several reasons:

- Verification: Insurers need to verify that the claim is legitimate and that you are indeed unable to work due to a medical condition.

- Benefit Calculation: Accurate proof of income and employment details help insurers calculate the correct benefit amount.

- Fraud Prevention: Requiring detailed documentation helps prevent fraudulent claims, ensuring that only genuine claims are paid out.

- Compliance: Insurers are required to comply with regulatory standards, which often mandate thorough documentation for claims.

Tips for a Smooth Claim Process

To ensure that your claim is processed smoothly, consider the following tips:

- Keep Records: Maintain organised records of your income, medical reports, and employment details.

- Be Honest: Provide accurate and truthful information to avoid complications or denial of your claim.

- Consult Your Insurer: If you are unsure about the required documents, consult your adviser or insurer for guidance.

- Update Regularly: Keep your insurer updated about any changes in your medical condition or employment status.

Conclusion

Income protection insurance is a valuable resource that can provide financial stability during challenging times. By understanding the proof requirements and preparing the necessary documents, you can ensure a smooth and efficient claim process. Remember, the key to a successful claim is providing accurate and comprehensive information to your insurer.

Income Protection Insurance for Doctors

The Importance of Income Protection Insurance for Doctors

As a medical professional, your primary focus is undoubtedly on the health and well-being of your patients. However, it's equally important to take care of your own financial health and security. This is where income protection insurance comes into play.

Income protection insurance is an essential safety net for doctors. It ensures that you can maintain your lifestyle and meet your financial obligations even if you are unable to work due to illness or injury. This type of insurance provides peace of mind, knowing that your income is protected, allowing you to focus on your recovery without the added stress of financial worries.

In this blog, we will delve into the importance of income protection insurance specifically for doctors. We will explain how it works, the benefits it offers, and the key factors to consider when choosing a policy. Whether you are just starting your medical career or have been practicing for years, understanding income protection insurance is crucial for safeguarding your financial future.

Get a Quote

Why Doctors Need Income Protection Insurance

High Earning Potential and Financial Commitments

As a doctor, you likely enjoy a high earning potential, which comes with its own set of financial responsibilities. These can range from substantial student loans and mortgages to the ongoing costs of running a medical practice. Such financial commitments can be daunting, especially if an unexpected illness or injury prevents you from working.

Risk of Occupational Hazards

While doctors are dedicated to caring for others, they are not immune to health issues themselves. The medical profession can be physically and mentally demanding, increasing the risk of burnout, stress-related illnesses, and physical injuries. Income protection insurance ensures that you have financial support during recovery periods.

How Income Protection Insurance Works

Definition and Coverage

Income protection insurance, also known as disability insurance, is a crucial safeguard for your financial security. This insurance provides a portion of your pre-tax income if you are unable to work due to illness or injury. Typically, these policies cover between 50% to 70% of your income, ensuring you can maintain your standard of living while focusing on your recovery.

Waiting Period and Benefit Period

- Waiting Period: This is the period you must wait after becoming unable to work before you start receiving benefits. Common waiting periods range from 30 to 90 days, but some policies offer shorter or longer periods.

- Benefit Period: This is the length of time you will receive benefits. It can range from a few years to until retirement age, depending on the policy.

Choosing the Right Policy

Own Occupation vs. Any Occupation

- Own Occupation: This type of policy pays out if you are unable to perform the specific duties of your medical specialty. It’s particularly beneficial for doctors, as it provides coverage tailored to your unique skills and responsibilities.

- Any Occupation: This policy pays out only if you are unable to perform any job for which you are reasonably suited by education, training, or experience. While typically less expensive, it offers less comprehensive coverage.

Get a Quote

Factors to Consider When Choosing a Policy

Premium Costs

When considering income protection insurance, it's essential to understand that premiums can vary significantly based on several factors. As a doctor, your occupation, age, health status, and the level of coverage you choose will all influence the cost of your premiums.

Exclusions and Limitations

As a doctor, it's crucial to carefully review any exclusions and limitations in your income protection insurance policy. These exclusions can significantly impact the coverage you receive, so understanding them is essential for ensuring your financial security.

Common Exclusions:

- Pre-existing Conditions: Many policies exclude coverage for illnesses or injuries that you had before the policy started. It's important to disclose your full medical history when applying for insurance to understand how pre-existing conditions might affect your coverage.

- Specific Types of Injuries: Some policies may not cover certain types of injuries, especially those related to high-risk activities. For example, injuries sustained from extreme sports or hazardous hobbies might be excluded.

- Illnesses Related to Specific Activities: If you engage in activities that are considered high-risk, such as scuba diving or rock climbing, illnesses or injuries resulting from these activities might not be covered.

Financial Strength of the Insurer

Choose an insurer with a strong financial rating to ensure they can pay out claims when needed. Research the insurer’s reputation and customer service record as well.

Case Study: Dr. Smith’s Experience

Dr. Smith, a 45-year-old orthopedic surgeon, had a thriving practice and a comfortable lifestyle. However, an unexpected back injury left him unable to perform surgeries. Fortunately, Dr. Smith had an income protection insurance policy with an “own occupation” definition. This policy provided him with 70% of his pre-tax income, allowing him to cover his mortgage, practice expenses, and personal living costs while he focused on recovery. Without this insurance, Dr. Smith would have faced significant financial hardship.

Choosing the Right Advisor

Look for an advisor who has experience working with doctors and understands the unique financial challenges and needs of medical professionals. For example, Morgan Insurance Brokers is known for their expertise in providing tailored insurance solutions for medical professionals.

We understand the specific risks and financial commitments that come with running a medical practice and can offer personalised advice to ensure you have the right coverage. We can assist with obtaining your income protection insurance, and also other insurances such as life insurance too.

Conclusion

Income protection insurance is an essential safeguard for doctors, providing financial stability and peace of mind in the face of unexpected health challenges. By understanding the different types of policies and key features, you can choose the right coverage to protect your income and secure your financial future. Don’t wait until it’s too late—consider your income protection options today and ensure you have the support you need to continue your vital work with confidence.

Get a Quote

Is it Worth Having Income Protection Insurance?

Is It Worth Having Income Protection Insurance?

Income protection insurance offers a tax-free monthly income replacement if you are unable to work due to injury or medical reasons. This coverage includes benefits for both mental health issues, like stress-related conditions, as well as physical ailments such as back pain, cancer, or stroke.

You may be thinking “is income protection insurance really worth it?” Well, with income protection insurance, you gain peace of mind knowing that you have a financial safety net to cover your bills during periods of illness or injury. Depending on the policy, coverage continues until you either return to work or reach retirement age.

Here’s how it works –

Coverage – The insurance typically covers up to 70% of your pre-tax income. However, some insurers may have a monthly cap on the maximum amount they pay out.

Waiting Period – There’s a waiting period between when you become unable to work and when the payments begin. Longer waiting periods often result in lower premiums.

Benefit Period – The benefit period is the length of time the insurance company will provide payments, usually ranging from two to five years or until you reach a certain age, like 65.

Premiums – The cost of premiums depends on factors such as your age, occupation, health, lifestyle, the coverage amount you choose, the waiting period, and the benefit period.

Exclusions – The insurance doesn’t typically cover situations like deliberate self-harm, suicide attempts, normal pregnancy and childbirth, war, or criminal activities.

Get a QuoteWhen is it Worth it?

Here are some scenarios where income protection insurance is worth considering –

When you have limited savings and/or dependents

If you have limited savings and people who rely on your income, income protection insurance can help maintain financial stability and cover essential expenses like rent or mortgage payments, groceries, utility bills, etc.

When you are self-employed or a casual worker

If you are self-employed or a casual worker without access to sick leave or paid time off, income protection insurance becomes even more critical. It replaces the income you would lose due to an illness or injury, ensuring you can still manage your financial obligations.

According to the Australian Bureau of Statistics (ABS) as of August 2023, there are 1 million independent contractors in Australia who may not have access to sick leave. Additionally, 2.7 million employees (22% of all employees) are not entitled to paid leave. These figures highlight significant aspects of the Australian workforce and their working conditions and how income protection insurance can play a vital role in protecting the workers of Australia.

Get a Quote

When you have debts and financial obligations

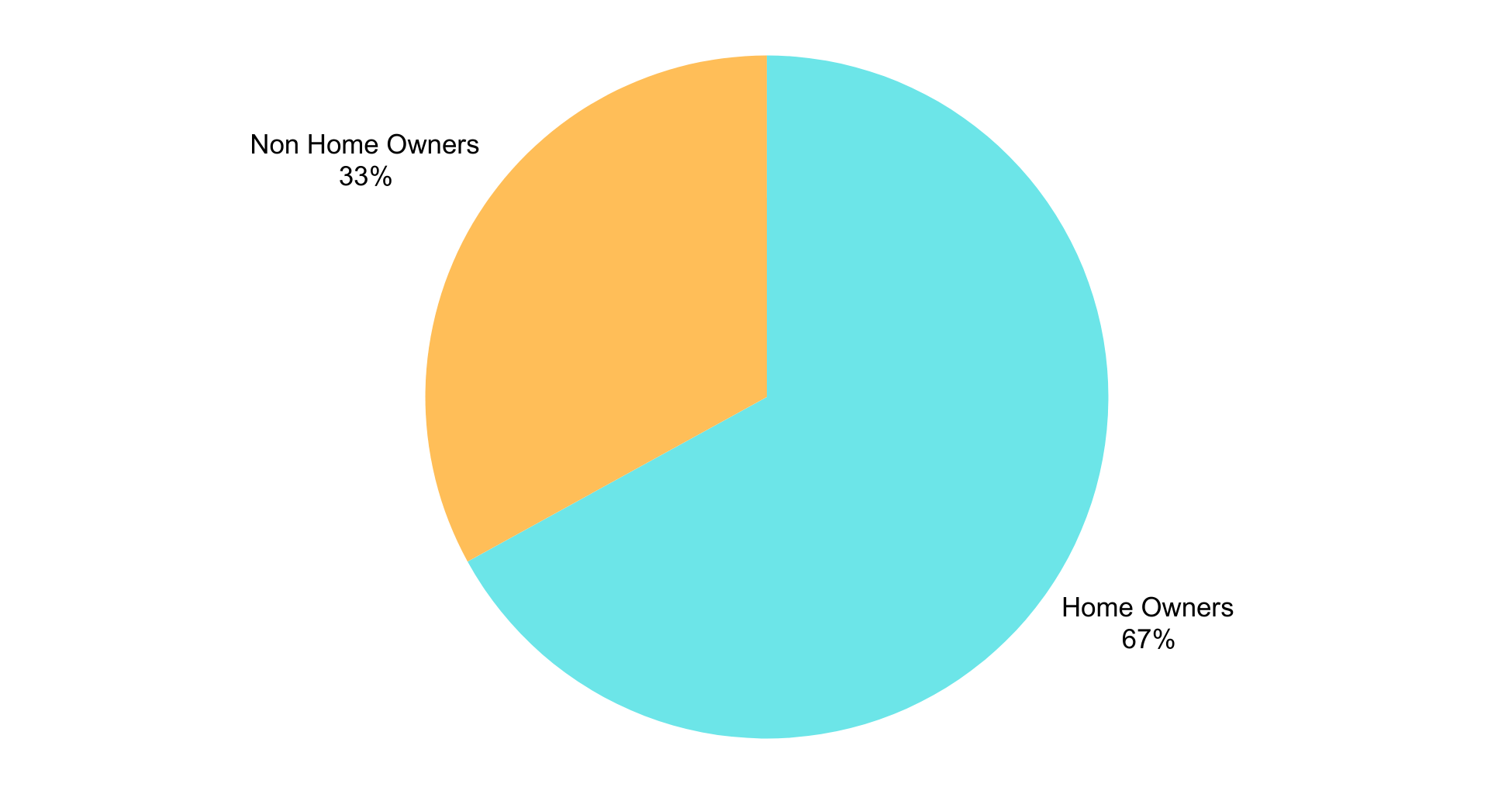

If you have major financial obligations such as a mortgage or rent, car loans, or credit card debt, income protection insurance can help you stay on top of your repayments. It provides a financial buffer, reducing the risk of defaulting on your loans and potentially facing financial difficulties. According to the Australian Bureau of Statistics (ABS), 66% of Australian households own their home, either outright or with a mortgage. This high rate of homeownership shows the importance of income protection insurance. For homeowners, maintaining mortgage payments is crucial to avoid financial distress or even foreclosure in the event of an unexpected illness or injury.

When you work in a high-risk occupation

If your job involves physical labour, operating machinery, or other high-risk activities, the chances of work related injuries are higher. Income protection insurance can be beneficial in such occupations, offering financial support during recovery.

When is it No Longer Worth it?

While income protection insurance offers valuable financial security, there are certain situations that make it less of a priority.

Sufficient savings and low expenses

If you have a sufficient emergency fund or minimal expenses, and can manage financially for an extended period without your regular income, income protection might be less crucial. This is particularly relevant if you have low or no debts and have no dependents.

Nearing retirement with ample savings

If you’re nearing retirement and have substantial savings, income protection will seem less appealing. Instead of paying premiums, you might choose to retire early if faced with a sudden health event, choosing to utilise savings for financial support.

Low-income earners

If you’re a low income earner, you might not find income protection insurance appealing compared to other types of insurance like Total & Permanent Disability insurance insurance which offers a payout if you are permanently unable to work, regardless of your earnings. This is because income protection insurance often replaces a portion of your income which might not be substantial for low-income earners.

Why Choose Morgan Insurance Brokers?

At Morgan Insurance Brokers, our team brings extensive experience, knowledge, and expertise in the insurance industry.

We recognise that obtaining the right income protection insurance can be challenging, particularly when looking for thorough coverage from a reliable provider. That’s why we’re committed to identifying the best coverage and pricing that fits your individual requirements. With connections to major insurers, our experts are here to help you navigate your choices and make an informed decision.

Our aim is to assist you in managing your rent or mortgage, handling everyday expenses, and ensuring you don’t have to depend on friends, family, or other sources for financial aid.

Get a QuoteWho Should Get Income Protection Insurance?

Income Protection Insurance in Australia acts as a financial safety net, offering peace of mind by providing income replacement if you can’t work due to illness or an injury. It’s important to note that this insurance covers a broad spectrum of health conditions, not just those related to accidents.

A few key characteristics of income protection insurance include:

- It replaces a portion of your income, usually up to 70% before tax.

- The payout is provided in regular monthly installments.

- It can be used to cover various financial needs, including medical bills, mortgage payments, utility bills, and even ongoing insurance premiums.

- It offers flexibility and customisation for you to tailor the policy to your needs and budget.

- It is especially crucial for self-employed individuals who lack access to employer-provided sick leave or disability benefits.

It is essential to understand that the cost of income protection insurance varies depending on factors like your age, occupation, health, chosen coverage amount, and the specific policy terms.

Occupations are categorised by risk levels; for instance, a construction worker would generally pay higher premiums than an office worker due to the higher risk associated with their profession. Policies covering a larger percentage of your income or offering a shorter waiting period comes with higher premiums.

Do you Need Income Protection Insurance?

When evaluating your need for income protection insurance, several factors come into play. Some of the factors to consider when determining if you require income protection insurance include:

-

Your employment status

If you are self-employed or work as a freelancer or contractor, chances are that you lack access to paid sick leave and annual benefits that are typically offered by employers. In such cases, income protection insurance becomes crucial in serving as a financial safety net during times of illness or injury.

-

Do you have dependents?

If you have family members or dependents who rely on your income for support, income protection insurance can provide peace of mind, knowing that their financial well-being is protected even when you cannot work.

-

Do you have savings?

Carefully assess the amount of savings you have or other funds to cover household bills and living expenses. If your savings seem insufficient to sustain your lifestyle for an extended period, income protection insurance helps bridge that financial gap while recovering from illness or injury.

-

Do you have existing debt obligations?

Do you have regular debt payments such as mortgage, utility bills, or other loans? If so, income protection insurance can help ensure you meet these financial obligations without risking default or financial hardship.

-

What is your personal risk tolerance?

Do you have an understanding of your capacity to manage financial uncertainty and income loss? Income protection insurance provides a safety net, allowing you to focus on recovery without the added burden of financial worries.

Alongside asking yourself these questions, it is important to create a personalised budget to gain a clearer picture of your monthly expenses and the income you might need to replace if you can’t work. This will help you determine the appropriate level of coverage you might need.

Which Premium Type is Right for me?

When choosing a premium type for income protection insurance, you will likely have the choice of stepped or level premiums. The choice you make will impact how much you pay now and in the future.

Stepped Premiums

These are recalculated at each policy renewal, and it is likely that at each renewal your costs will increase as you age and become more prone to illnesses. However, they are generally cheaper in the early years of the policy.

Level Premiums

These are not based on the policyholder’s age. They charge a higher premium at the start of the policy, but the cost changes over time and increases are not based on age.

The choice on which type of premium to choose is completely up to you. Morgan Insurance Brokers will help provide you general advice on making this decision but it is up to you to evaluate your personal and financial needs in deciding what’s best for you.

Why Choose Morgan Insurance Brokers?

At Morgan Insurance Brokers, we’ve recently added income protection insurance to our range of services because we know exactly how crucial it is to safeguard your financial future during rainy days.

Our team is committed to securing the ideal coverage for you at the best price and customised to meet your individual needs. With access to over 150 insurers, our skilled brokers will guide you through your options and help you make well-informed decisions.

Get a QuoteWhat income protection does not cover?

Income Protection Insurance in Australia acts as a financial buffer, offering a replacement income stream for individuals who are unable to work due to illness or injury. Instead of directly replacing lost income, it provides a monthly benefit, typically up to 70% of the insured person’s pre-tax income.

This benefit helps you manage a variety of financial commitments, from daily living expenses and medical bills to mortgage repayments and insurance premiums.

This safety net ensures that individuals can prioritise their recovery without the added burden of financial strain. It provides a sense of security, allowing individuals to focus on regaining their health while maintaining their financial stability and meeting their financial obligations. Like most insurance coverages, it acts as a personal rainy day safety net.

What does it Include?

Each income protection policy has a definition of partial or total disability that must be met before a claim can be made, and it is important to check with your insurer for their specific definitions.

Some of the most common things that income protection insurance cover includes:

- Injuries or illnesses that prevent you from working, as long as they are not listed as a specific exclusion in your policy.

- A percentage of your regular income while you are unable to work, allowing you to cover your living expenses.

Additionally, many policies offer coverage for rehabilitation services and ongoing medical treatments, providing a more inclusive safety net during your recovery period.

What income protection does not cover?

While income protection insurance acts as an essential safety net for individuals in cases of injury, and illnesses it does not cover everything. Pre-existing conditions, self-inflicted injuries, criminal activitiies, risky activities, elective surgery, and unemployment are the main circumstances that income protection does not cover. It’s important to note that just like most insurance policies, income protection insurance has its own list of exclusions too.

Here’s a list of the most common exclusions of what income protection does not cover:

Pre-existing medical conditions

Many income protection plans have limitations or exclusions related to pre-existing medical conditions. It’s essential to disclose any pre-existing conditions when applying for coverage, as failure to do so could result in a claim being denied.

Self-inflicted injuries

Intentionally self-inflicted injuries are excluded to prevent misuse of coverage. However, some providers may cover injuries resulting from a mental condition.

Pregnancy and Birth

Income protection insurance typically excludes coverage for normal pregnancy and childbirth. This means that any time off work due to these reasons won't be compensated under such policies, including maternity leave. You can refer to the governments fairwork policy on parental leave to determine if you are eligible for maternity or paternity leave entitlements.

Acts of war and terrorism

Income protection typically excludes injuries or illnesses resulting from war, as these situations are too unpredictable and broad for standard insurance coverage.

Criminal activities

Participation in illegal activities typically will lead to exclusion from coverage for any resulting injuries or illnesses.

Risky activities

Income protection policies may exclude coverage for injuries or illnesses sustained while participating in activities deemed risky. However, what is specifically classified as ‘risky’ will vary between insurance providers.

Unemployment

Situations related to job loss such as seasonal, self-administered, or the end of a fixed-term contract unemployment are typically not covered.

Voluntary elective surgery or treatment

Many insurance policies exclude or limit coverage for elective surgeries and non-emergency treatments. This means procedures that aren't medically necessary might not be covered.

It’s crucial to thoroughly review the terms and conditions of any income protection policy to understand the specific exclusions and limitations. Seeking advice from insurance brokers can be helpful in understanding these details and selecting the most appropriate coverage for you.

Why Choose Morgan Insurance Brokers?

At Morgan Insurance Brokers, our team brings extensive experience, knowledge, and expertise to the insurance industry.

Navigating the complexities of income protection insurance can be challenging, especially when seeking comprehensive coverage from a reliable source. We actively work to secure the best coverage at the right price, tailored specifically to your needs. Morgan Insurance also provides ourselves on education. We like to educate our clients on such topics such as what income protection does not cover.

We have recently expanded our services to include income protection insurance because we recognise the critical importance of protecting your income during challenging times. This coverage helps ensure you can meet your rent or mortgage payments, manage expenses, and avoid relying on friends and family.

Get a QuoteWhat does Income Protection Insurance Cover?

Within Australia, Income Protection Insurance is a financial safety net designed to replace a portion of an insured individual’s income if they become unable to work due to illness or injury. Income protection insurance provides regular monthly payments, typically replacing up to 70% of the insured person’s pre-tax income.

These payments help cover essential living expenses, ensuring financial security and stability during the recovery period. As an individual with income protection insurance, in the event of an unfortunate event, you can still maintain your financial obligations whilst focusing on recovery without the added stress of lost income.

How does Income Protection Insurance Work?

With an income protection insurance policy in place, you can help ensure that you and your loved ones will not be left with a major financial burden if you were to lose your income. The benefit payment can be used for various daily, monthly, and unexpected expenses including:

- Rent and mortgage payments

- Ongoing bills and everyday miscellaneous expenses

- Medical and rehabilitation costs

- Transportation costs

- The insurance premium itself

To understand how income protection insurance works, it’s important to know the key aspects of its operations.

Waiting Period

When you first purchase an income protection insurance policy, you have the option to choose a waiting period. This period represents the time you need to wait after becoming unable to work due illness or injury before your insurance benefits begin.

The waiting periods usually range from 30 days to two years, with shorter periods generally leading to higher premium costs. You can choose to tailor this to your financial capacity and savings, allowing you to manage expenses until the insurance payment commences.

Benefit Period

This refers to the duration for which the insurance will continue paying out benefits while you are unable to work. This can vary significantly depending on your chosen policy. Choosing an appropriate benefit period requires considering career longevity and potential health risks to ensure continuous financial coverage.

Claims & Payouts

If you experience an illness or an injury that prevents you from working, you would typically file a claim with your insurance provider. Once the waiting period you selected elapses, and your claim is approved, you will begin receiving monthly payments, typically up to 70% of your pre-tax income. These payments can be used to cover various financial obligations.

In essence, it operates as a financial safety net, providing you with income during times you are unable to earn due to health reasons.

What Specific Expenses are Covered?

Income protection insurance not only helps individuals cover the commitments listed below but also enables them to maintain their overall financial health by supporting their ability to save and invest during periods of income loss.

Day-to-day living expenses

This would include everyday costs of living, such as groceries, utilities, and transportation.

Medical and rehabilitation expenses

These costs can quickly add up and include doctor’s appointments, treatments, and therapies.

Mortgage and other debt repayments

Income protection benefits can help to prevent falling behind on loans for a house or car, as well as credit card payments.

Insurance premiums

This ensures the continuation of coverage from the policy during the benefit period.

This support is designed in such a way that it empowers individuals to focus on their recovery without the added stress of financial burdens.

What does it Not Cover?

Here’s a list of what income protection insurance does not cover:

- Some pre-existing medical conditions

- Injuries caused by self-harm

- War and terrorist activities

- Illegal activities

- High-risk behaviours

- Job loss

Always remember to thoroughly read and understand exactly what your policy stipulates before making a decision to purchase. Our brokers can help you navigate the complexities involved to make the most informed choice and secure coverage that best policy that meets your needs.

Why Choose Morgan Insurance Brokers?

At Morgan Insurance Brokers, we are a team of professionals with a wealth of experience, knowledge, and skill in the field of insurance.

As someone seeking income protection insurance, we understand how it might be complex to get all the coverage you need from a single, trusted source. Hence, we make it our mission to find the best coverage at the right price for your specific requirements. Our team of experienced brokers work with over 150 insurers, ensuring that you understand your options and can make an informed decision.

We recently expanded to include income protection insurance as part of our service offerings. We recognise the importance of safeguarding your income in times of hardship so that you can keep up with your rent or mortgage payments, daily expenses, as well as not rely on friends, family, or other third parties for financial support.

Get a Quote